Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

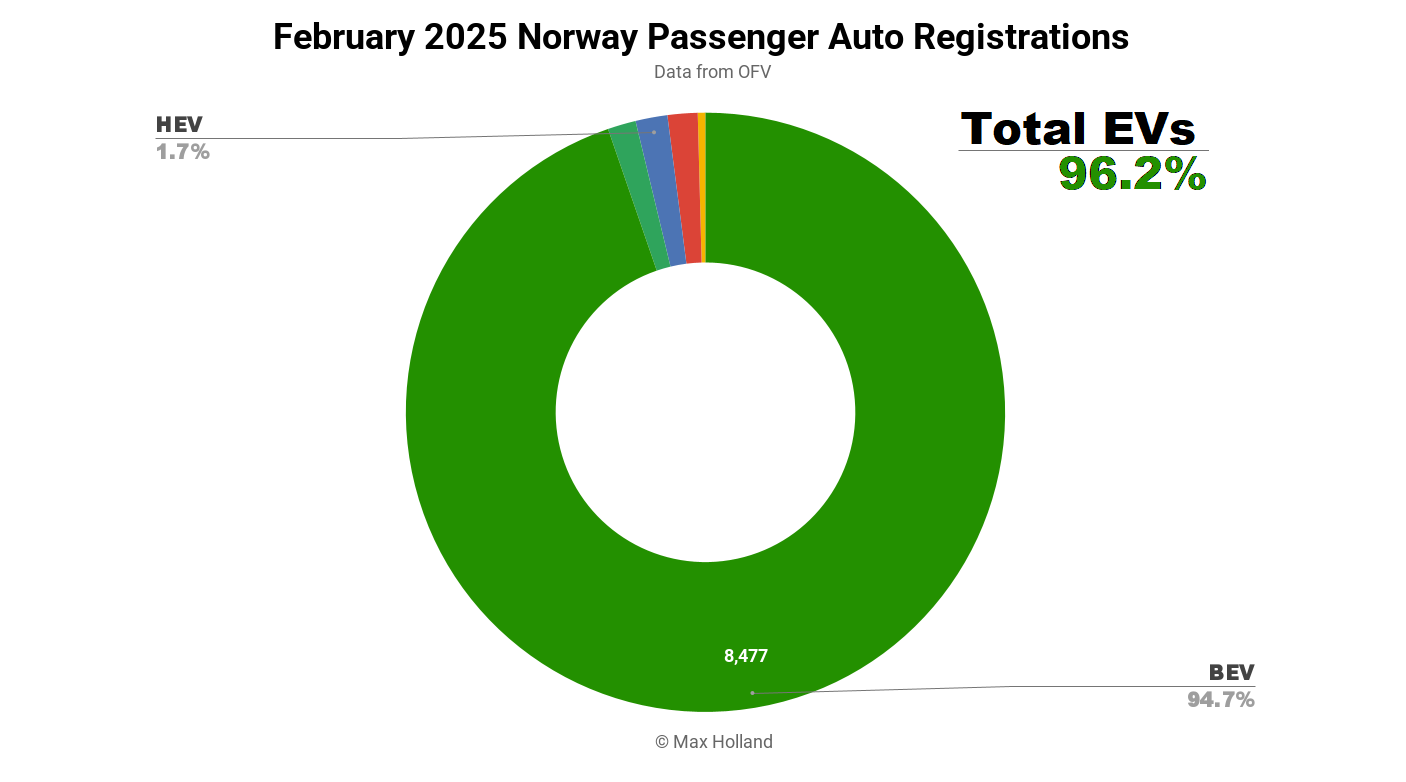

The February auto market saw plugin EVs take 96.2% share in Norway, up from 92.1% year-on-year. BEVs continue to squeeze out other powertrains, though diesels and HEVs are now outperforming PHEVs. Overall auto volume was 8,949 units, an increase of 21% YoY. The best-selling BEV in February was the Nissan Ariya.

February’s sales saw combined EVs take 96.2% share in Norway, with 94.7% full battery electrics (BEVs), and 1.5% plugin hybrids (PHEVs). These compare with YoY figures of 92.1% combined, with 90.1% BEV and 2.0% PHEV.

BEVs continue to slowly displace all other powertrains. Unfortunately, for the few people not ready – for whatever reasons – to switch over to BEVs, buying a new diesel or plugless hybrid (HEV) is now preferred over buying a PHEV (or EREV). Year-to-date, the market share of the non-BEVs has been:

- 1.54% for Diesels

- 1.52% for HEVs

- 1.26% for PHEVs

- 0.38% for Petrols

This is not great, since the plugin hybrids can readily travel 80+% of their annual km on electricity, whilst still being flexible enough to give assurance to anxious folks (or technophobes), in all kinds of extreme conditions. By contrast, all the non-plugins are obviously fully dependent on fuel combustion for all their energy.

As discussed in December’s report, 2024’s vehicle weight taxes (specifically aimed at targeting PHEVs) made PHEVs notably more expensive, so much so that consumers now prefer diesels and HEVs over PHEVs. While some were obsessing about PHEVs, diesel share in full year 2024 was 2.28%, barely dented from the 2.45% of 2023. Just to be clear, the goal should be to incentivize BEV > PHEV > HEV > ICE (obviously).

New tax policies will come into effect from April 1st 2025 which are designed to further tweak the incentive structures. Let’s hope the policy-makers are not throwing out the baby with the bathwater and in practice not making diesels and HEVs a preferable choice compared to PHEVs (again). This kind of simplistic absolutism (“we want all-BEVs right now”), and targeting PHEVs for a lack of purity, reminds us of Weber’s distinction between Gesinnungsethik and Verantwortungsethik.

The former, Gesinnungsethik, is a more ideological moralistic stance – appealing as “simple messaging” when starting a movement, but taken too far, becomes (dysfunctional) puritanicalism and monomania. The latter, Verantwortungsethik, is focused more on practical ethical outcomes, and considers consequences. My assessment is that the wrong approach prevailed, regarding PHEVs.

All this might seem academic now that Norway is near the end of the transition, and indeed these are relatively minor issues in the grand scheme of things. But precisely because Norway has been the pioneer, these are precisely the steps (and a few mis-steps) that other nations can learn from and improve upon, in their own transitions. Let’s keep an eye on how the April policies shape the Norwegian market.

Best-Selling Models

The Nissan Ariya was a rare winner of the top rank in February, with 608 units delivered, climbing up from 3rd last month. February’s 608 units result was actually below the Ariya’s recent peak volume of 630 units in October (only enough for 5th rank back then). This time around, with other models at more modest volumes, the Ariya won the top spot.

In second place, close behind, was the Tesla Model Y, with 604 units, presumably still all the outgoing version, as the refresh is due to arrive in March. The Toyota BZ4X was in third with 530 units.

There were only a couple of notable moves in the top 20. The most important was surely the Kia EV3 climbing into the top ten (9th spot), with 275 units, in only its fourth month on sale. This is a great result – and the EV3 may climb further still.

There were four new models that made their debuts in February. The highest volume debutant was the Hongqi EHS7, which came in strong with 50 initial units. The EHS7 is a large SUV (4,925 mm) which starts at just 479,900 NOK (€40,780) for the 2WD 88 kWh (gross) “Comfort” variant. This entry variant has a WLTP range of 475 km and 250 kW peak DC charging, capable of recovering from 10% to 80% SOC in around 20 minutes. This is a great value package for those needing a larger vehicle.

There’s also the “Premium” trim, a 4WD variant with the same battery 88 kWh, for just under 500,000 NOK (coming in under the higher tax threshold). At the top end, there’s a 111 kWh “Exclusive” variant rated at 540 km WLTP. Both these 4WD options have around 620 PS, so are rather fast in a straight line. As some Norwegian reviewers have stated, you are getting a vehicle roughly in the segment of the original Audi e-tron, but for Tesla Model Y money.

Next up was the new Skoda Elroq, which saw 42 starting units. I’ve detailed the Elroq elsewhere; it’s basically an Enyaq but foreshortened at the rear by 20 cm. It starts from 299,900 NOK (€25,400) for the 50 kWh (usable) variant.

The Cupra Tavascan has also just made its first sale in Norway, with a modest 4 units. This is Cupra’s take on the mid-sized MEB-based SUV, at 4,644mm – almost the same length as the Skoda Enyaq. The Tavascan comes only in a smoothed off coupe-back shape, unlike most of its MEB cousins (which offer choices on shape). The starting price is from 469,000 NOK (€39,850) with a 77 kWh battery.

The final debutant was the new Renault 5, with just 2 initial units. These are likely testing units for now, we should expect higher volumes when true customer deliveries commence in the next couple of months. The pricing starts from NOK 249,900 (€21,230). As I asked in regard to the Hyundai Inster, in last month’s report, I don’t know whether vehicles the size of the Renault 5 (at 3,922 mm) might be considered by many to be a bit too small to be “the only car you need” in Norway. At least the Hyundai Inster has a bit of ground clearance to avoid clumps of winter snow and ice, more so than the Renault 5. I’ll be interested to watch how these two get on, relative to each other.

Talking of the Hyundai Inster, in its second month of registrations, it stepped up to 62 units, a good result. Let’s see how much further it climbs. Another recent newcomer, the Audi A6 e-tron, grew to 34 units in February. The Zeekr X, having only seen a thin scattering of units over the past 3 months, finally stepped up to a decent 27 units in February.

Let’s now turn to the 3-month rankings:

Based on their large December volumes, the Tesla Model Y and Model 3 still lead the chart. The Volkswagen ID.4 comes in a close 3rd.

There aren’t many big moves compared to the prior period (August to November), though two stand out. The Ford Explorer saw good volumes in the lead up to the end of 2024 (as a member of the EEA, Norway is part of the emissions region which counts for EU emissions regulations), but has since decreased substantially, and dropped from 10th down to 19th. This is yet more proof that most legacy auto makers are only doing “just enough to meet regulatory requirements”, and are not serious about transitioning to EVs.

The other notable move was a positive one for the new Kia EV3, which – back in November – had only just debuted. It has now entered the top 20 for the first time, in 18th spot. It will climb further from here, and may get close to, perhaps inside, the top 10.

It’s too early to predict whether newer models like the Hyundai Inster will sustain monthly volumes sufficient to permanently enter the top 20 chart (beyond perhaps an occasional big shipment period). The BEV market is fairly mature now in Norway (though there’s still plenty of room for improvements in price and segment-diversity). I would guess that – in this market – we can only expect two or three instances of all-new models challenging established members of the top 20 (in a sustained manner) per year from now on.

Don’t take this conservatism as a guide to all car markets, however. There is obviously huge disruption still in store for most auto markets around the world in the years ahead. Part of the unique aspects of Norway’s case – apart from being already near the end point of the EV transition – is that it is a very wealthy market, so smaller cars (the highest selling cars in many global markets) are not necessarily the highest volume models in Norway. Added to that, the large distances and long, cold winter (with heavy precipitation) are additional reasons why small-and-affordable cars have a lower demand in Norway, compared to almost all other markets.

That being said, just a step above the small-and-affordable sector, there are compact, capable, and great value cars that can still be amongst the highest volume sellers, even in Norway. Europe is now at the point where these kinds of models have already started to be BEV-ified (the Volvo EX30 last year, the Kia EV3 this year). This is the price-point of the market which is being disrupted now, and as a result, after this next year or so, the future prospects of later arrivals in this segment continuously displacing these BEV leaders will only get narrower. It will still happen occasionally, but not nearly as frequently as in the past few years – when all segments were fresh spring pastures for BEVs.

Outside of Europe, the BEV transition has allowed the core BEV technologies to see cost improvements which now allow for profitable (and compelling) models even in small-and-affordable segments. Witness the many impressive small-and-affordable BEV models that exist in the Chinese market, for example. Whilst Norway is not the ideal market for these smaller segments, these BEVs are starting to be (and will increasingly be) the major disruptors in many other markets. We’ve seen the BYD Dolphin Mini topping the BEV charts in Brazil and Colombia (and elsewhere in South America), and these kinds of affordable cars will be the huge disruptors throughout Africa and Asia also.

Outlook

As we saw above, the auto market expanded in February, by 21% YoY. The broader Norwegian economy actually saw a YoY contraction in Q4 2024, of negative 0.3%. Note that, in Norway’s case, the macro economic data can be heavily swayed by government expenditures, and by fossil fuel export volumes (and global prices) – such that headline GDP figures can swing wildly, so we can’t read too much into a single quarter. Norway’s inflation was stable at 2.3% in January (latest), and interest rates remained at 4.5%. Manufacturing PMI improved to 51.9 points in February, from 51.3 in January.

It’s interesting to track Norway’s transition into the end-game of BEV adoption, and see the various dynamics playing out. If anyone has detailed insights into the upcoming new tax and incentive policies (due April 1st), the “thinking” behind them, and predictions for how they will influence the powertrain shares going forward, please let us know below.

Regarding the fleet status, the latest data is still from the end of 2024, when BEVs held 27.7% fleet share, with PHEVs holding an additional 7.2% share. This was up from 24.2% BEV share 12 months prior (and note that PHEV share was unchanged YoY).

What are your thoughts on Norway’s auto market? Please jump into the comments section to share your perspective.

Whether you have solar power or not, please complete our latest solar power survey.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy