Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

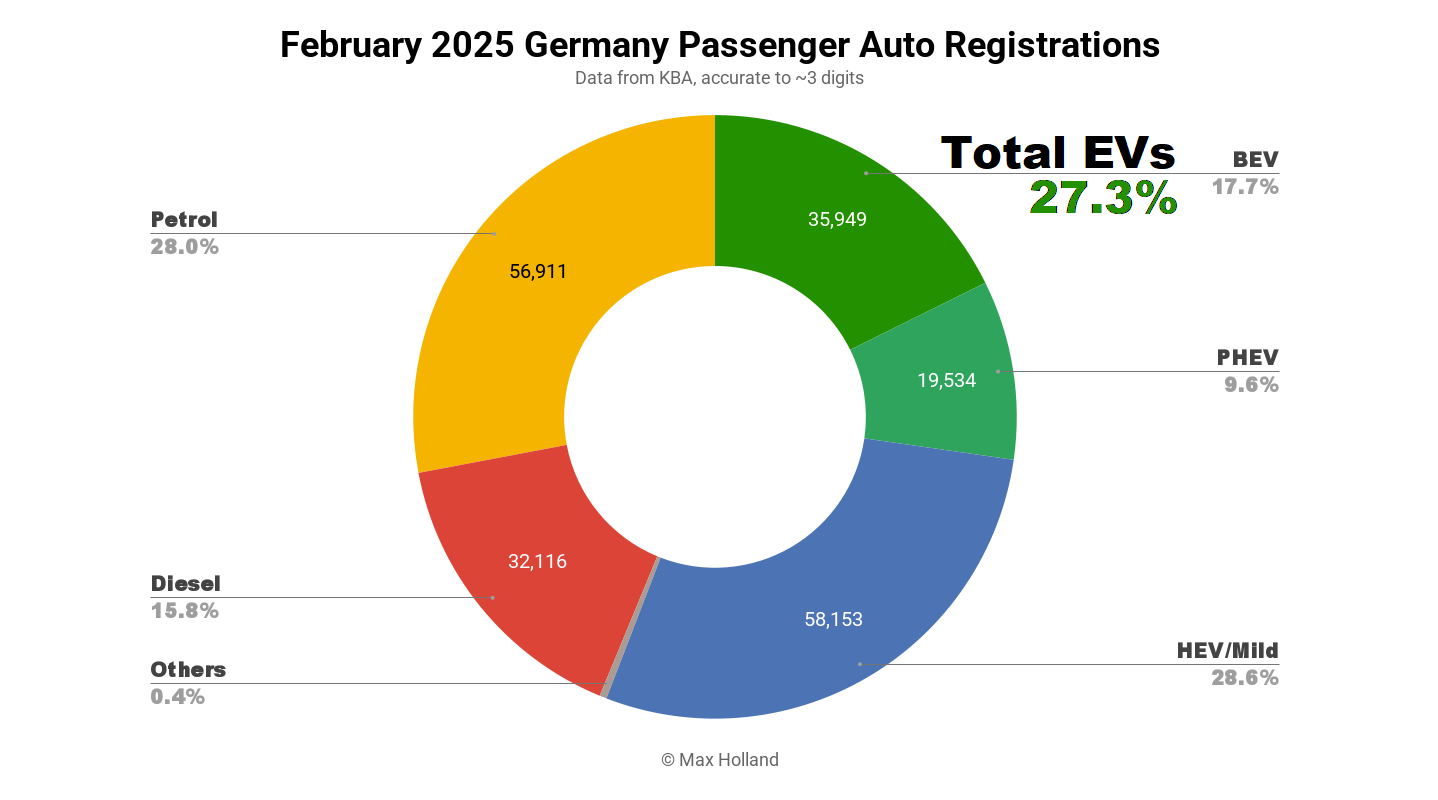

February saw plugin EVs take 27.3% share in Germany, up from 19.3% share year‑on‑year. BEVs were back to decent volume compared to 2024, though only modestly ahead of February 2023 figures. PHEVs have stepped up modestly. Overall auto volume was 203,434 units, down some 6% YoY. The best-selling BEV in February was again the Volkswagen ID.7.

The February auto market saw combined EVs take 27.3% share in Germany, with full electric vehicles (BEVs) at 17.7% share, and plugin hybrids (PHEVs) at 9.6%. These compare with YoY figures of 19.3% combined, 12.6% BEV, and 6.7% PHEV.

Recall that early 2024 BEV volumes were still reeling from an unexpected blow – the sudden cancellation of BEV incentives in December 2023. Thus the direct YoY comparison is not particularly illuminating. If we check back on the BEV share in prior years, February 2021 saw 9.4%, February 2022 saw 14.1%, and share grew to 15.7% in February 2023. The earlier period thus saw the highest growth rates, but the transition has been lethargic since 2022.

Setting aside the discombobulation of early 2024, to require two years to grow from 15.7% to 17.7% is obviously not impressive, nor even “a transition” as such. As I mentioned last month, without incentives to pad the profits of manufacturers, Germany is not going to be prioritised for supply of the limited number of BEVs that will be sold across Europe in 2025. Even beyond Germany, most European manufacturers are still only reluctantly making BEVs, being forced to do so by legislation. Until this attitude changes – having blocked competition from more competitive China-made BEVs via tariffs – the transition in Europe will go as slowly as the legacy manufacturers can get away with. And luckily for them, the EU Commission has just proposed watering down the emissions requirements for 2025.

On a positive note, even in the remaining non-plugin powertrains, combustion-only sales are giving way to HEVs and MHEVs. As the latter category grew to 28.6% share, petrol-only fell to a near-record low of 28.0% share.

Best-Selling BEV Models

The Volkswagen brand took a clean sweep of the top three rankings. The Volkswagen ID.7 took the top spot for the second consecutive month, with 2,971 units. In second place was the ID.4 / ID.5 with 2,507 units, and the ID.3 came in third with 2,008 units.

The next three spots went to Volkswagen Group cousins; the Skoda Enyaq, Audi Q4 e-tron, and Cupra Born.

Although many of the models in the top 20 are regulars, towards the bottom of the table are two notable new members. The new Audi A6 e-tron, which debuted in Q4 last year, had by far its best volume yet, with 704 units, and took 16th spot.

The other new member was the new Renault 5, which also debuted in Q4, and saw 656 units in February, almost double its January volume. This put the Renault 5 in 17th place in the ranking, and it likely still has further to climb.

The Renault’s close competitor, the Hyundai Inster (434 units) is still outside the top 20 for now, but don’t count it out of an appearance in the coming months. The other well-known B-segment competitor widely talked about in Europe, the Citroen e-C3, is still only slowly ramping German deliveries, with 154 units in February.

It may be that Citroen’s owner, Stellantis, will take a multi-brand approach to the B-segment in Germany. The manufacturer has just registered a couple of units of the new Fiat Grande Panda in February, and we may expect customer volumes of this model in the coming few months. The Fiat 500 has already been an incredibly successful model in Germany, often in the top 3 back in both 2022 and 2023, partly thanks to a modest starting price which the purchase incentive transformed into a perceived bargain.

After the December 2023 incentive cancellation, the Fiat 500 rapidly cooled, with a short-lived resurgence in the summer of 2024. Perhaps the most likely scenario is that Stellantis may just de-prioritise the German market for these lower margin models, since incentives for them are available elsewhere in Europe. Please weigh in on this in the comments.

Here’s the trailing 3-month ranking:

Volkswagen Group models took the top 5 spots, with the VW ID.7 in a strong lead, followed by the Skoda Enyaq, and VW ID.4 / ID.5.

Further back, the Cupra Tavascan has climbed to a solid 10th position thanks to three months of solid volumes, a great result for the Cupra brand, an increase from its 19th position last month. The Dacia Spring remains in 17th place, unchanged over January, but a big climb over most of 2024 when it effectively withdrew due to the EU tariffs.

Here’s a quick look at manufacturing group performance:

As usual, the home-teams dominate, with Volkswagen Group taking 46.3% of the market over the past three months. Compared to the prior period (September to November), they took an additional 3.4% of the market share pie.

BMW Group remains in second place, though it lost 2% of the market since the prior period, now at 13.1% share. Mercedes Group remains in third, lost 3.4%, and is now at 8.2%.

Except for the Volkswagen Group, only Renault Group gained a bigger slice of the market since the prior period, adding an additional 2.6%, now at 4.4%. This is almost entirely due to the recent growth of the Dacia Spring and Renault 5, discussed above.

Outlook

The loss of volume in the German auto market was mirrored in the broader German economy over recent months. The GDP figures for Q4 2024 showed a YoY reduction of 0.2%, the sixth consecutive month of recession. Inflation remained flat at 2.3%, with ECB interest rates now at 2.65%. Manufacturing PMI improved to a still-negative 46.5 points in February, from 45.0 in January.

With the EU Commission now watering down the previously agreed fleet emissions requirements for 2025, and Germany no longer a priority European market due to the lack of incentives, what will the rate of transition look like in 2025? There’s at least now a few more affordable BEV options, like the B-segment vehicles mentioned earlier, though that’s “in theory” because it seems likely that these will be supply limited. After all, these models were only released (in late 2024) because of the planned tighter 2025 targets. Those targets are now weakened.

What are your thoughts about how 2025 will play out for the EV transition in Germany (and Europe overall)? How long can the legacy auto makers continue to delay getting serious about BEVs? Please share your thoughts in the discussion below.

Whether you have solar power or not, please complete our latest solar power survey.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy