Why is everyone selling their digital gold? Trump literally made a Federal Bitcoin Reserve dedicated to BTC last week.

Lately, crypto has been on such a losing streak that even its biggest cheerleaders are running out of excuses:

- BTC and ETH ETFs approved

- USA adopting BTC as a reserve

- President of US and most famous person on earth issued a memecoin

None of these narratives were enough to shake us out of a bear market. And now the doomers are saying crypto has peaked its mindshare and it has begun its perennial downward slide. How true is this?

DISCOVER: 9+ Best High-Risk, High–Reward Crypto to Buy in March 2025

Bitcoin Reserve Starts As Wild Failure

At the heart of Trump’s plan is the government’s significant Bitcoin stash, which has been seized over the years in criminal and civil investigations. David Sacks, the White House cryptocurrency czar, estimates these holdings now total around 200,000 Bitcoin, currently valued at $16.7 billion. The executive order directs the U.S. Treasury Department to audit these assets and manage them as reserves, similarly to gold and foreign currencies.

“This Executive Order underscores President Trump’s commitment to making the U.S. the ‘crypto capital of the world,’” Sacks stated, further describing the initiative as a “digital Fort Knox.”

The order also goes a step further by tasking the Treasury and Commerce Departments with developing strategies for acquiring more Bitcoin. However, any purchases must be “budget-neutral,” meaning they won’t incur extra costs for taxpayers.

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

Market Response to the Bitcoin Reserve Announcement

The market reacted quickly to the news, and not entirely favorably. Bitcoin’s price initially dipped to $84,713 following the announcement, only to recover slightly to around $88,982. Investors had been expecting a more aggressive buying strategy and were left disappointed by the lack of fresh purchasing power behind the plan.

Altcoins saw similar trends. Markets saw Ethereum and Solana drop as traders moved fast to cover their bets against further losses. The sell-off, dismissed by analysts as a panicked overreaction, might calm down in the weeks ahead.

CRYPTO WAS BETTER BEFORE TRUMP

$3,900 ETHEREUM $2,000 ETHEREUM pic.twitter.com/njTU9GunWn

— That Martini Guy ₿ (@MartiniGuyYT) March 9, 2025

Moreover, Trump’s crypto dealings are stirring a pot of ethical disputes. Long before the Oval Office, he unveiled World Liberty Financial and cashed in on a memecoin bearing his likeness, raising questions about where business ends and governance begins. With legal fights around crypto progressing under his administration, those lines look even blurrier.

Adding to that anxiety is civil forfeiture laws. Crypto advocates cite instances of baseless asset seizures, warning that the Justice Department might exploit its reach to claim cryptocurrency holdings under newly minted executive orders.

The Trump Effect is a Hot Mess

While Trump has been winning with his strongman rhetoric and hardline immigration stance, his economic moves have left something to be desired.

- Announces tariffs

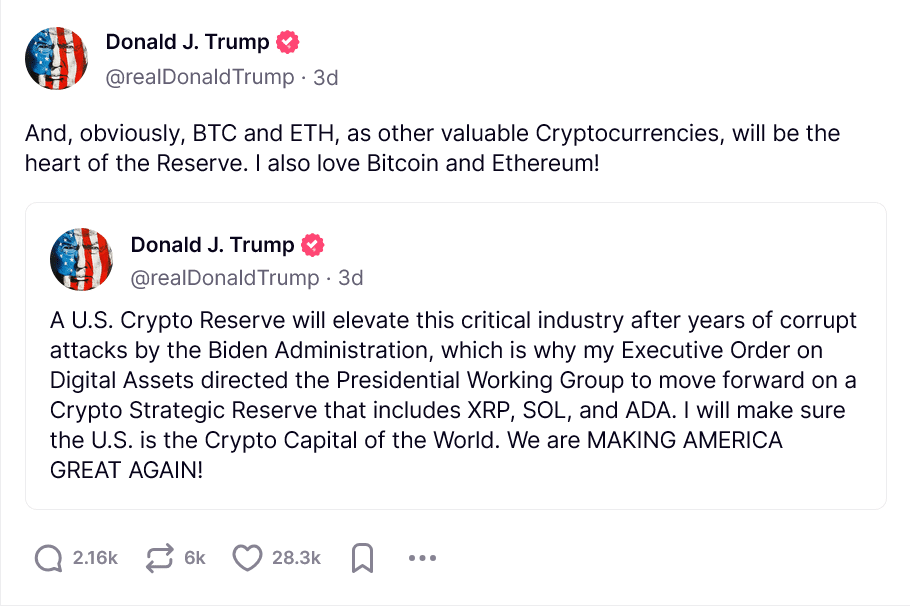

- Shilling his own portfolio (totally didn’t forget BTC in his original reserve announcement)

- Stirring uncertainty to cause fear, which will scare away investors.

However, 99Bitcoins analysts do see a vision where all of this is temporary pain and Trump’s economic blueprint could work:

- Since COVID assets have been too high for middle-class investors and this crash gives them a chance to jump back into the market

- ETH ETF Staking may get approved this month. It was filed Feb 14 and acknowledged by the SEC on Feb 25. Will increase yield and make holding more attractive.

- Texas Crypto Reserve recently moved to the next steps and might get approved in March or April. This includes both BTC and crypto with a $500 billion marketcap (ETH is closest).

- There is an Arizona reserve at the same steps but only includes BTC. The Utah bill passed but they chickened out and removed the crypto reserve completely.

- M2 supply is hinting Bitcoin will rise end of March.

Basically, there are a lot of good possibilities in March, but then again, we might have to wait months until Bitcoin hits all-time highs again.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Why is everyone selling their digital gold? Trump literally made a Federal Bitcoin Reserve dedicated to BTC last week.

- However, 99Bitcoins analysts do see a vision where all of this is temporary pain and Trump’s economic blueprint could work.

- Texas Crypto Reserve recently moved to the next steps and might get approved in March or April.

The post America Is Creating a Bitcoin Reserve But Crypto is Crashing: What The F? appeared first on 99Bitcoins.