Is Saylor’s Strategy (Formerly Microstrategy) Over-Leveraged? MSTR Price takes a nose dive with Bitcoin as the market loses confidence.

At $239.27 at the time of writing, shares of Strategy, formerly MicroStrategy, a business intelligence firm trading on Nasdaq, are down nearly 22% from Friday’s highs and over 50% from their 2024 peaks.

By November 2024, Strategy shares were trading at nearly $550, spiking to all-time highs as Bitcoin and crypto prices defied gravity. During that time, Bitcoin, the world’s most valuable coin, broke above $100,000 for the first time, drawing capital in a wave of FOMO.

(BTCUSDT)

Strategy Share Prices Falling Amid Worse US Stock Market Day Since 2022

Fast-forward three months, and investors are concerned that crypto and equity prices are falling at a faster rate than anticipated. The sell-off, especially of MSTR, coincides with crypto prices crashing, shedding, on average, over 30% from their respective all-time highs.

Even some of the best meme coins to buy in March 2025, including Dogecoin and Shiba Inu, have not been spared.

Eyes are especially on Strategy shares, which are plunging sharply, with some now questioning the sustainability of its model. Strategy has more Bitcoin stockpiles than any public company in the world.

In the last bull run, and even before that, institutions seeking indirect exposure to Bitcoin bought MSTR shares as they rode the upward trend.

As prices turn lower, it appears that investors are re-evaluating their positions, particularly after President Donald Trump signed an executive order creating the first Bitcoin and crypto reserve in the United States.

The recalibration of portfolios, which may include exiting MSTR, also coincides with concerns about the administration’s harsh trade policies and the possibility of the Federal Reserve holding rates at current levels for longer.

Strategy Has a Bitcoin Plan: Inside the Mind of Michael Saylor

If Bitcoin prices fall in light of these developments, MSTR shares will likely continue falling.

Technically, the immediate support level is at $230. If Strategy share prices break below this level, the probability of MSTR dropping to $200 will be high. However, the pace of this sell-off will depend on whether Bitcoin prices drop. Presently, the coin has primary support between the $75,000 and $80,000 zone.

For investors, it is tricky to hold onto MSTR shares and even trust the firm’s model. Since 2020, Strategy has been leveraging debt and share sales to purchase more Bitcoin. As of March 11, 2025, Strategy held 499,096 BTC, worth over $33 billion at spot rates. On average, the firm bought each coin at $66,357.

They plan to buy even more BTC in the future by raising additional capital from debt and stock sales.

Under the 21/21 Plan, Strategy aims to raise $42 billion to buy BTC over the next three years. In late February, they issued a $2 billion convertible senior note with a 0% coupon that matures on March 1, 2030, to buy BTC. It should be noted that these notes are unsecured and are senior obligations, meaning they are not backed by collateral but have priority in payments.

On March 10, 2025, the firm notified the United States SEC of its plan to sell $21 billion worth of its preferred stock.

Are Cracks Forming in Saylor Bitcoin Strategy?

Bullish as Strategy is on Bitcoin—a coin whose founder, Michael Saylor, has said is a better store of value and is digital gold—prices are cooling off, and its share prices are crumbling.

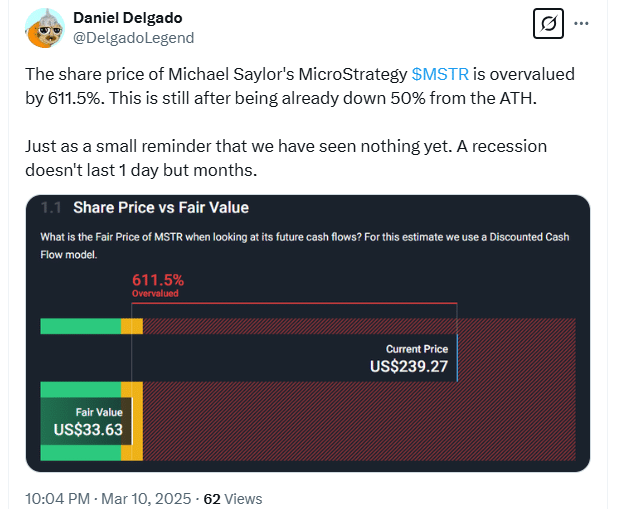

Strategy is worryingly leveraged, overly dependent on debt to finance its BTC acquisitions. For this reason, share prices become sensitive whenever Bitcoin prices begin to fall.

(Source)

If Bitcoin continues selling off, dropping below the average purchase price of around $66,000, it may put a strain on the firm’s balance sheet.

In turn, this may fast-track the Strategy share crash, and it could be the start of people doubting the firm’s Bitcoin strategy.

Some think Strategy’s BTC haul, which is worth billions at spot rates, may not be enough to offset the risks associated with its current debt load and market volatility.

As such, it remains to be seen how Strategy will navigate these challenges if prices continue dipping lower.

Combined with market and economic uncertainty, price structure weakness evident in charts–even of some of the best cryptos to buy in 2025–, and monetary policy anxiety, it is highly likely that bulls will have a tough time in the next few weeks or months.

During this time, Bitcoin may slump below 2021 highs in a bear trend continuation formation.

Key Takeaways

- MSTR share prices free-falling

- Falling Bitcoin prices sowing doubts on Strategy’s model

- Investors are closely monitoring Bitcoin and MSTR prices. Will holders find reprieve?

The post Strategy Stock Tumbles: Has Market Lost Faith in Saylor’s Bitcoin Strategy? appeared first on 99Bitcoins.