Gold has indeed maintained its allure and value over time, with its popularity enduring across centuries. The metal’s unique properties, such as its bright yellow color, durability, and resistance to corrosion, have made it a highly sought-after material for various applications, including jewelry, coins, and electronics.

Gold’s Timeless Appeal:

Historical Significance: Gold has been a symbol of wealth, power, and status throughout history, with ancient civilizations prizing it for its beauty and rarity.

– Investment and Store of Value*: Gold is often used as a hedge against inflation and market volatility, with many investors turning to it as a safe-haven asset during times of economic uncertainty.

Industrial Applications: Gold’s high ductility, conductivity, and resistance to corrosion make it an essential material for various industrial applications, including electronics, dentistry, and aerospace .

The Allure of Gold:

Aesthetic Appeal: Gold’s bright yellow color and ability to be alloyed with other metals to create various hues have made it a popular choice for jewelry and decorative items.

Rarity and Exclusivity: Gold’s relative rarity has contributed to its value and exclusivity, with many people seeking to own gold as a status symbol or investment.

Emotional Connection: Gold is often associated with emotions, such as love, luxury, and achievement, which has helped to maintain its allure and desirability.

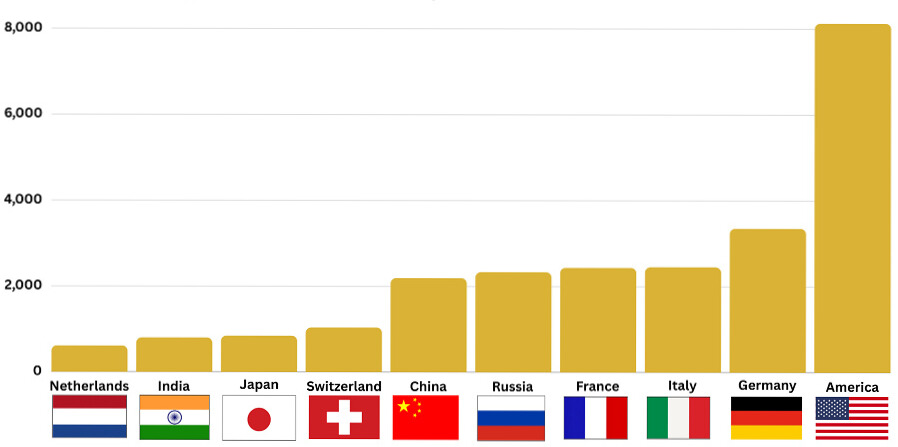

Top 10 Gold Reserve By Country

Chief amongst the buyers in recent years has been China, which has recorded a 15-month consecutive buying spree for the precious metal. Other countries that have seen significant purchases in 2023 is Poland and Singapore. Countries buying large amounts of gold reserves is considered to be one of the key drivers that has helped support the gold price in 2023 despite interest rates being higher. The question is: has their gold buying put them high up our top 10 list?

1. United States of America – 8,133 Tonnes

The nation with the most gold reserves is, unsurprisingly, the USA. Their total is by far the largest of all

the nations on our list, holding 4,000 tonnes more than second-place Germany, but this total is subject

to concerns and criticism.

The first problem is accuracy. Documents pertaining to the authenticity of gold bullion held in both New

York and at Fort Knox has either gone missing or been destroyed. Rules introduced in 1974 were

supposed to mean a one-time check of all America’s bullion, but gold has been found to have been

accessed and potentially tampered with since that inspection.

The second is the consideration of foreign gold holdings. The US, like Britain, France and Switzerland,

has often been a safe haven for gold bullion reserves in times of civil or national conflict. There are

those who believe that America’s reserve total also includes Germany’s national gold reserves (amongst

others) which, until repatriation in 2013, were held in New York.

The final part is purity. With much of the US gold reserves from older acquisitions, some experts believe

the United States holdings are not fine quality bullion and that, were they melted down and remade into

24-carat bars, the total holding would come down dramatically.

2. Germany – 3,352 Tonnes

Germany boasts the second largest gold reserves in the world. Germany’s gold is held in three places:

The Deutsche Bundesbank headquarters in Frankfurt’s banking district, New York’s Federal Reserve

Bank, and the Bank of England vaults in London.

Due to the Cold War, most of Germany’s gold was evacuated to ally nations. In 2013, the Bundesbank

declared it would repatriate a little over 40% of the country’s gold; 20% held by the United States

(300 tonnes) and a little over 20% from France. This was to be achieved by 2020 at the latest, but

despite opposition from America, Germany received all of its gold – ahead of schedule – in 2016.

Interestingly, Germany’s information on their holdings is probably the most transparent in the world.

The Deutsche Bundesbank pursues this as a deliberate policy, arguing that transparency breeds

confidence for investors and the wider public. Some of the bank’s gold is on display for the public

to see in their Money Museum in Frankfurt.

3. Italy – 2,451.86 Tonnes

Italy’s gold reserves are some of the most stable in the world – something which cannot be said for

the country’s wider economy. Italy has struggled in the aftermath of the Financial Crisis of 2008/09,

and is currently (April 2019) in recession for the fourth time in 10 years.

The nation’s gold reserves however have remained untouched since 1999 – 20 years ago – at 2,452

tonnes approximately. Italy was a notorious exporter in the 20th Century and a hub of European trade.

Recent economic distress has reduced the country’s output, but Italy still remains one of the larger

European economies – even if it is burdened with significant debts.

Back in 2019, BullionByPost reported a dispute between Italy’s coalition government (Five Star & Lega)

and the European Central Bank. Lega Nord, the right wing party, accused the ECB of wanting to keep

Italy’s gold away from the government and the people, while Beppe Grillo – founder of the Five Star

Movement – worried the European bank by blogging about the benefits of Italy selling a chunk of its

gold reserves to avert a VAT rise, in a similar fundraising fashion to the French bullion sale.

4. France – 2,436.34 Tonnes

France was previously in third place, before selling off 500 tonnes of gold. The Bank of France was

actioned to do so by then-Economy Minister Nicolas Sarkozy (President of France 2007 – 2012).

In May 2004, Sarkozy launched the sale and reduced France’s gold reserves by 20%. The logic was

to use the money raised to invest in currencies and bonds, and use the interest made to pay off

France’s debts.

Gold is held at the Banque de France headquarters in Paris. La Souterraine, as it’s better known, is

a secure underground vault for French national reserves, as well as gold owned by the IMF.

5. Russia – 2,332 Tonnes

In 2019 Russia leapfrogged China into fifth place for the world’s largest gold reserves. Russia are

also the third largest producer of gold in the world. President Putin has aggressively pushed a

program of rapidly increasing the nation’s gold reserves over the last 12 years; a policy which had

begun slowly a decade before that.

The Russian Federation is often at odds with the United States, and considering the US Dollar is

the chief international reserve currency, this puts Russia at a disadvantage. Now with war in

Ukraine, many are expecting Russia to retain gold for its reserves to combat the impact of a weak

rouble and the heavy toll of international sanctions, though whether the world is privy to any new

gold bullion holdings is another matter.

6. China – 2,191 Tonnes

China used to have a policy of mining gold, selling it, and reinvesting into its economy, but as the

economy has caught up with major Western nations now, the country has begun building up the

percentage of its reserves held in gold.

The Asian superpower had only previously disclosed information regarding its gold reserves on

four occasions between 2000 and 2015, but since November the country has issued monthly

updates on its additions to the reserve total.

Since the end of 2022, China has consistently purchased more and more gold reserves, increasing

from 1,948 in 2023 to the current figure of 2,191 tonnes. China has been moving further and further

from using the US dollar as tensions between the two nations continue to falter. The Chinese economy

however has been struggling since the pandemic, with growth falling, and sectors like property facing

a debt crisis.

If China’s gold reserve purchases continue then we could soon see them move further up the list to

overtake the likes of Russia and France.

7. Switzerland – 1,040.01 Tonnes

In what’s becoming a trend within the list, 2024’s figures don’t differ much from what was

recorded for bullion reserve holdings in 2023. Switzerland, like Japan, has not added more gold yet.

Switzerland is famous as a nation of banking, tax exemptions, and geopolitical neutrality. Despite

being dogged by rumours of stealing Nazi gold at the end of the Second World War, Switzerland

has a strong reputation for financial expertise and facilitating international trade.

The country holds the majority of its gold reserves at the Swiss National Bank in Bern (70%), but

for safe keeping it also has 20% with the Bank of England and 10% with the Bank of Canada.

8. Japan – 845.98 Tonnes

Japan remains unchanged in both its position in this rankings list and based on how much gold

bullion it currently holds in reserve.

Japan’s gold reserves are approximately 2% of its total reserves. The country is in an odd situation

where its traditional policy, to regularly buy gold, was halted in 2011 following the Fukushima

nuclear disaster. The country sold gold reserves to help stabilise the economy in the wake of the

incident and hasn’t really picked up where it left off.

Another point to consider is the Japanese Yen. This is a safe haven asset in its own right, along

with gold, Treasury bonds, and the US Dollar. If anyone were to not need huge amounts of gold in

reserve, it would be the creator of a rival safe haven asset.

9. India – 800 Tonnes

India is the second most populated country in the world, behind China. It is also the second

largest consumer of gold, behind China. Gold is popular in India, and the Metals and Minerals

Trading Corporation of India (MMTC) is partnered with Swiss refiners PAMP to provide

LBMA-approved metal to the region.

In the past year India has added a further 40 tonnes of gold bullion to its reserves; a low sum

but hardly surprising given the ongoing political and economic instability in the country.

The Reserve Bank of India in Mumbai holds over half of India’s gold reserves, while the rest is

jointly held by the Bank of England and the Bank for International Settlements in Basel, Switzerland.

10. Netherlands – 612 Tonnes

The only new entrant to the list, the Netherlands come into the top 10 at the expense of Turkey

The only new entrant to the list, the Netherlands come into the top 10 at the expense of Turkey

– something of an ongoing battle after Turkey bumped them out of the list in 2020 and 2021.

In recent history the Netherlands has been more of a selling nation for bullion, and they make

this list purely by virtue of having not made any further sales in recent years and economic

changes under the Erdogan regime in Turkey.

In 2014 the country repatriated a good chunk of their gold. At the time, New York was home to

51% of all Dutch gold. 20% of the Netherlands’ overall gold holdings were shipped back to De

Nederlandsche Bank to even the figures out at 31% per Amsterdam and New York. A further 18%

of this total is stored in London with the Bank of England (roughly 110 tonnes) and 20% is stored

in Ottawa.