In a significant move reflecting its strategic realignment, Fortuna Mining Corp. has agreed to sell its Burkina Faso operations, including the Yaramoko Mine, for $130 million. This decision comes as the company aims to optimize its asset portfolio and focus on projects with longer mine lives and lower operational risks.

Yaramoko Mine: A Brief Overview

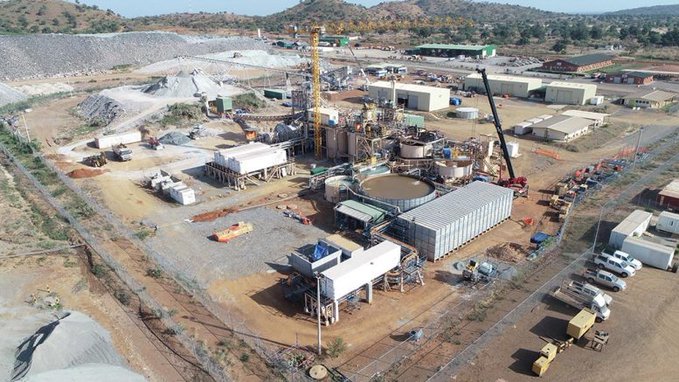

The Yaramoko Mine, acquired by Fortuna in July 2021 through the purchase of Roxgold Inc., has been a noteworthy asset in the company’s portfolio. Operational since May 2016, the mine reached a milestone in May 2024 by producing its one-millionth ounce of gold. As of December 31, 2023, Yaramoko had proven and probable mineral reserves of 0.9 million tonnes at a grade of 7.90 g/t gold, containing 219,000 ounces of gold. The mine’s remaining life was projected to extend until 2026, with an exploration budget of $6.1 million allocated for 2024, including 41,450 meters of drilling.

Strategic Rationale Behind the Sale

Fortuna’s decision to divest its Burkina Faso operations aligns with its broader strategy to streamline its asset base and concentrate on core projects. The Yaramoko Mine, while productive, faced challenges such as a limited mine life and geopolitical uncertainties in the region. In September 2024, Burkina Faso introduced a new mining code and related local content laws, adding layers of regulatory complexity.

Additionally, political developments, including the formation of the Alliance of Sahel States by Burkina Faso, Niger, and Mali, and discussions about withdrawing from the Economic Community of West African States (ECOWAS), have introduced further uncertainties. These factors likely influenced Fortuna’s decision to exit the region and reallocate resources to more stable jurisdictions.

Financial and Operational Implications

The $130 million transaction is expected to bolster Fortuna’s financial position, providing capital to invest in projects with higher returns and longer mine lives. The company has been focusing on optimizing its existing operations, such as the Séguéla Mine in Côte d’Ivoire and the Lindero Mine in Argentina, which are projected to have more extended operational horizons.

In 2024, Fortuna reported record production of 455,958 gold equivalent ounces, with the Yaramoko Mine contributing approximately 25% of this output. Despite Yaramoko’s significant contribution, the mine’s short remaining life and the increasing complexities of operating in Burkina Faso made its divestment a strategic choice for the company.