Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and/or follow us on Google News!

Last Updated on: 12th April 2025, 08:22 pm

The Northern Lights carbon capture and storage project is often described as a logistics system, but at its core, it is a storage facility. The Øygarden terminal, its connecting offshore pipeline, and the Johansen Formation are the infrastructure that turns cross-border CO₂ shipments into permanent geological sequestration. Phase 1 is not a study or a roadmap. It is a constructed facility with injection-ready wells, a pressurized and instrumented seabed pipeline, and an onshore buffer system designed to receive, re-pressurize, and inject 1.5 million tons of carbon dioxide per year. The emitters may vary, the ships may evolve, but this section of the system is designed to be permanent.

This article is part of a short series on Northern Lights. In the first article, I looked at the customers doing carbon capture. The recent decision by BASF to walk away from a shipping and storage agreement for its Antwerp-based Kairos@C project illustrates the central dilemma: even when the engineering is sound, the business case is fragile.

Phase 1 of Northern Lights is now fully subscribed, but only through a mix of government-backed Norwegian projects, EU-subsidized BECCS initiatives, and one low-cost industrial emitter—Yara—with an ideal location and pure CO₂ stream. Capture costs for most participants remain well above €100 per ton, and in some cases, approach or exceed €150 per ton. The economics simply don’t pencil out on carbon pricing alone. Even in best-case scenarios—where capture sites are next to water, liquefaction is on-site, and shipping distances are manageable—the need for subsidies remains. The one emitter not waterside in a port which the ships can use plans a pipeline which is, in my opinion, unlikely to be permitted, and is trucking 20 tons at a time 100 km to a waterside facility. Phase 2 would require a fivefold scale-up, and there’s little evidence yet that this model can be replicated without even deeper public support or a significantly higher carbon price.

In the second article, I focused on the maritime transport system at the heart of Northern Lights—a fleet of custom-built CO₂ carriers that link emitters in Norway, Denmark, the Netherlands, and Sweden to the Øygarden storage terminal on Norway’s west coast. From an engineering perspective, the system is cutting-edge: cryogenic tanks, LNG propulsion, wind-assist rotor sails, and careful integration with port and storage infrastructure. But from an economic and scalability standpoint, it’s a fragile and costly solution to a problem we should be avoiding upstream.

Each ship carries around 6,500 to 7,000 tons of liquefied CO₂ per voyage in Phase 1, and planned Phase 2 ships will increase that to 12,500 to 20,000 m³. But the cost of maritime transport—including capital, operations, LNG fuel, and emissions—adds roughly €30 per ton to the overall CCS process. With only a few vessels in rotation, the system relies on tight scheduling and minimal room for error. Delays at sea or congestion at terminals can quickly cascade into backlogs at emitter sites, which are all storing CO₂ in buffer tanks on-site. As distances increase in Phase 2—Stockholm to Øygarden is nearly 2,000 km round-trip—the logistics become even more vulnerable and emissions from the ships themselves rise, reaching 30,000 to 50,000 tons of CO₂ annually from propulsion alone.

Norway has covered 80% of the capital cost for this fleet and the storage facility through its sovereign wealth fund. Even so, the economics remain tenuous. Unlike pipelines, ships require constant fueling, berthing, weather routing, and staffing. Every emitter needs its own liquefaction plant, every port its own cryogenic loadout. This isn’t a replicable backbone—it’s a bespoke workaround. And while it makes Northern Lights viable in the short term, the long-term trend is already visible: emitters like Yara are evaluating pipeline-connected alternatives with lower lifecycle costs.

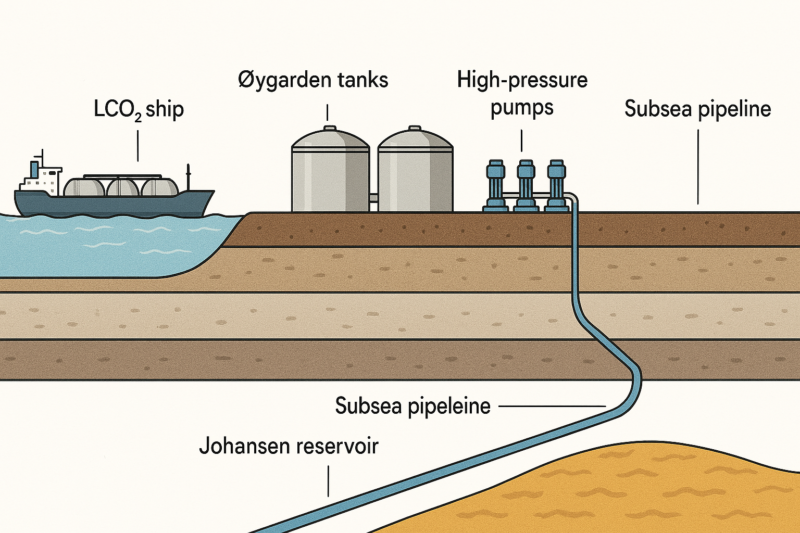

And so to the sequestration site the ships are sailing to. The Øygarden terminal sits on the rocky coastline of western Norway, built into the fjord-adjacent industrial zone north of Bergen. In Phase 1, it includes twelve cylindrical buffer tanks, each with a capacity of approximately 625 cubic meters, totaling 7,500 cubic meters of storage. That equates to one full shipment from a 7,500 m³ liquefied CO₂ carrier. The tanks are designed to hold liquid CO₂ at around –26 °C and 15–19 bar. Insulated and pressurized, they bridge the gap between marine delivery and pipeline injection. When a ship arrives, the CO₂ is offloaded via cryogenic transfer arms and enters the buffer system. From there, it is pumped to higher pressures, metered, and pushed into the subsea pipeline at injection conditions—approximately 110 to 150 bar depending on depth, temperature, and flowrate targets. The site includes real-time sensors for pressure, temperature, composition, and flow.

The offshore pipeline is approximately 100 kilometers long, terminating in the Johansen Formation beneath the North Sea. It is a 12- to 16-inch diameter steel pipeline, internally coated to handle dry CO₂ and designed to resist ductile fracture from decompression or phase change. The pipeline transports CO₂ in dense phase—not fully liquid, not gaseous, but supercritical. Temperature and pressure are maintained along the route to avoid transitions that could affect flow. The burial depth and routing were selected to minimize risk from trawling, anchor strike, or seabed shifting. Operational flowrates are tailored to match injection wellhead pressure and reservoir absorptive capacity, which has been estimated at many tens of millions of tons.

The injection target is the Johansen Formation, a thick layer of porous sandstone located approximately 2,600 meters below sea level. It is overlaid by a dense shale caprock and bounded by additional geological features that limit upward migration. Seismic mapping, stratigraphic modeling, and reservoir simulations have confirmed its suitability for long-term storage. The injected CO₂ will occupy pore space in brine-saturated rock, spreading laterally and gradually dissolving. Northern Lights has committed to active monitoring, including seismic surveys, pressure measurements, and geochemical tracers, to validate plume movement and containment. The wells themselves are steel-cased, cemented, and equipped with packers and safety valves. The expected active injection lifespan is 20 to 30 years, with a further multi-decade post-closure monitoring period in compliance with the EU CCS Directive.

The system as built is as elegant, efficient, and engineered as it’s possible for a long-duration garbage dump to be. But it is not easily replicated. The location of Øygarden provides a unique intersection of deepwater port access, short offshore distance to storage, stable geology, and permitting under a single national authority. The cost of developing the onshore terminal, offshore pipeline, and wells is significant—estimated at over 700 million USD for Phase 1. The injection formation is well-characterized, one of many such in Europe, but most aren’t as accessible. The system’s throughput is limited by the number of ships it can receive, the volume it can buffer, and the capacity of the wells. Expansion beyond Phase 1 requires new wells, more tanks, and more storage at emitters’ sites. None of these costs scale easily.

Even if Phase 2 proceeds, the Øygarden terminal will remain the only injection point. It is not connected to a broader network. There is no continental pipeline feeding into it. Each emitter must solve liquefaction, storage, and scheduling on their own. The pipeline from the terminal to the formation is robust, but short. It cannot accommodate new routes. It cannot expand geographically. It is a terminus. The facility may operate for decades and may remain a high-performing carbon sink. But it is not a model for European CCS scale-up. It is a closed loop with limited reach, and every ton of CO₂ it stores will continue to depend on marine logistics until a broader network is built—if one ever is.

Even with the Norwegian government covering 80% of the capital costs for Northern Lights Phase 1, the cost of storing carbon underground at Øygarden remains significant. When subsidies reduce the project’s upfront capex from €700 million to just €140 million borne by the operator, and annual opex still runs between €28 and €35 million per year over 25 years, the fully loaded cost of storage lands between €22 and €27 per ton of CO₂. That’s just for the terminal, the offshore pipeline, and the injection wells—excluding the cost of capture, purification, liquefaction, or marine transport. For emitters, it’s a real cost—one they still have to absorb or pass along, even in a best-case subsidy environment. The Norwegian state may be underwriting the infrastructure, but the business case still depends on someone paying €20-plus per ton just to make carbon disappear into rock. That’s on top of expensive capture, cleansing, liquefaction and buffering storage for best case, waterside locations, and then shipping.

Without 80% capex subsidies, the very favorably located site would be charging double that for sequestration. Other sites, frequently a lot further out to sea, will cost more. The costs of CCS are becoming very clear, and I suspect its future is radically more limited than the fossil fuel industry has been claiming.

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy