Both crypto market and stocks have shrugged off the anxiety swirling around Trump Liberation Day 2025 Tariffs. The upcoming US tariff reveal on Wednesday promises to disrupt global trade, but investors seem unfazed—for now.

The question hanging overhead is whether Trump will continue with his plan or back out.

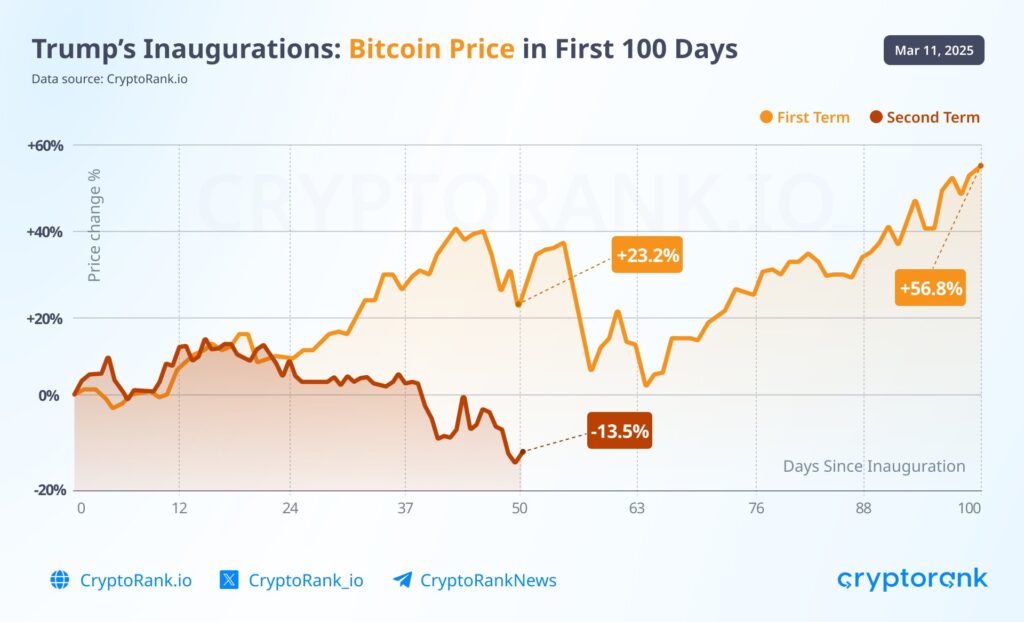

So far this cycle had a 90% correlation to Trump’s first term in 2017 until these recent tariffs. Here’s the latest on the markets, the tariff fallout.

Trump Liberation Day 2025 Tariffs: What’s The Deal With Trump’s Plan

At the heart of “Liberation Day” lies Trump’s dual-path tariff strategy, which could take U.S. trade policy down drastically different roads. On one hand, the universal tariff plan proposes a flat rate of up to 20% on all imports, regardless of trade partner. On the other, the reciprocal tariff plan targets nations with existing duties on U.S. goods, aiming to mirror their rates in what Trump has called “a fair fight.”

Trump doesn’t seem like he actually wants to be hyper aggressive or unjust with the tariffs, so it’s really other country’s game to lose. You could probably call him and be like “hey, we don’t want tariffs, what do you need from us?” and either fulfill what is either an easy request or meet him halfway.

Correction – we dont know the bottom is in..we just know we are in the bottoming zone. https://t.co/kV3NVtVyh4

— Raoul Pal (@RaoulGMI) March 30, 2025

Markets have held firm despite the looming tariff storm. Analysts are split, with some thinking the potential fallout has already been priced. Others believe the quiet reflects optimism about long-term benefits.

Trump’s team touts them as both leverage against foreign duties and a massive revenue generator, with Trump aid Peter Navarro floating a $600 billion annual estimate.

These predictions involve several risks. Industries like tech, autos, and manufacturing face direct hits from supply chain shocks, and possible retaliation from trade giants like China and the EU is also in play.

Will Trump Walk Back Tariffs?

Screenshot this. No, he won’t. We’re predicting Trump is going full speed ahead with tariffs.

That said, a few theories have populated online that Trump will suddenly have a “very productive conversation” with everyone and take all the teeth out of whatever the tariffs end up becoming. They’ll only tariff single malt whiskey and one grade of steel, etc.

The theory’s simple enough. Backing out of tariffs, or toning them down, allows Fed Chair Jerome Powell to freeze rates, the neutral rate tick up, and the economy to adjust to a mildly higher inflation baseline. Call it steadying chaos.

The mask slipped at the latest FOMC meeting. Powell hammered “tariff inflation” harder than expected. For a guy allergic to politics, his sudden focus was telling.

Final Thought on Trump Liberation Day 2025

Against all odds, both crypto and stock markets have started the week in the green, defying widespread expectations of a downturn ahead of President Trump’s widely anticipated “Liberation Day.”

Trump’s Liberation Day tariffs could fundamentally reshape global trade for years to come. Whether universal or reciprocal, the decisions made this week will ripple across global markets.

DISCOVER: Best Meme Coin ICOs to Invest in March 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Both crypto market and stocks have shrugged off the anxiety swirling around Trump Liberation Day 2025 Tariffs.

- At the heart of “Liberation Day” lies Trump’s dual-path tariff strategy, which could take U.S. trade policy down drastically different roads.

- For now, the debate about cryptocurrency’s place in America’s financial future is just beginning.

The post Crypto Markets Flip Bullish on Trump Liberation Day 2025 Tariffs appeared first on 99Bitcoins.