Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

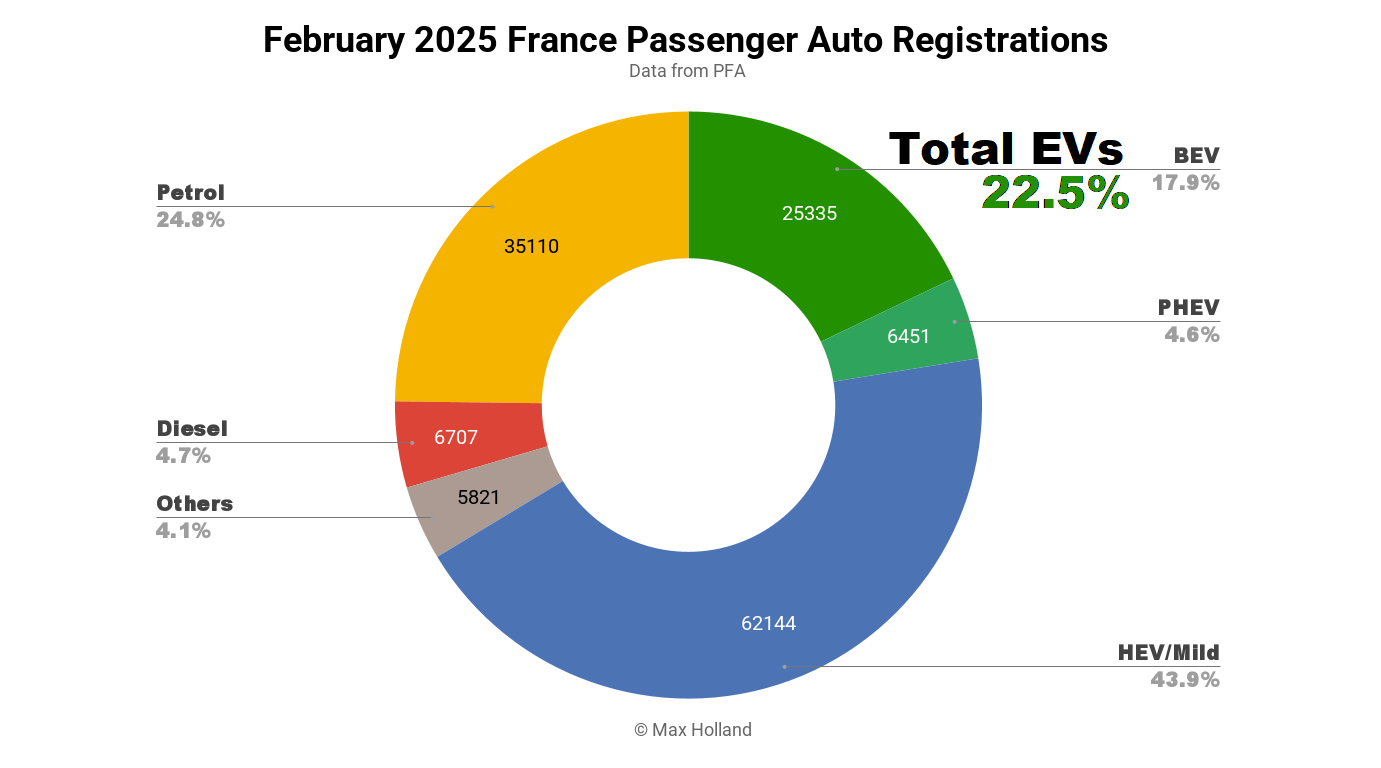

February’s auto market saw plugin EVs at 22.5% share in France, down from 26.3% year-on-year. BEVs were effectively flat YoY, whilst PHEVs lost share. Overall auto volume was 141,568 units, roughly flat YoY. The Citroen e-C3 was France’s best selling BEV in February.

February saw combined EVs at 22.5% share in France, with full battery electrics (BEVs) at 17.9%, and plugin hybrids (PHEVs) at 4.6%. These compare with YoY figures of 26.3% combined, 18.1% BEV, and 8.2% PHEV.

The plugin market is currently still irregular, shaped by a mid-February delivery deadline to successfully qualify for the 2024 eco-bonus (which is significantly reducing thereafter). As we noted last month, the PHEV market is now dampened by a weight tax which has been applied to the class for the first time from January 1st 2025, making the year-on-year comparison look unfavourable.

We will have to wait for the end of Q2 for these uneven policy influences (both this year, and in the YoY baseline) to disperse, and also for the new Tesla Model Y (almost 10% of the French BEV market in 2024) to arrive in decent volumes. The mid-year will also likely see the further ramp up of the more affordable BEVs (R5, e-C3, Inster, Panda) to higher volumes, and the arrival of the likes of the Citroen e-C3 Aircross, and Renault 4.

Meanwhile, what’s left of the plugless market continues to move over to the short-term fix of more mild-hybridization and more HEVs, such that combustion-only powertrains continue to fall.

Diesel-only saw volume drop from 10,221 to 6,707 YoY (down a third), and share at under 5% for the second consecutive month. Petrol-only volume fell from 48,075 to 35,110 YoY (down 27%) and share of under 25% for the second time (following December ‘24). Unless there’s some one-off pull-forward of these powertrains, it is hard to see diesels climbing back over 5% and petrols will also soon (by H2 this year) consistently be under 25%.

Best Selling BEV Models

The Citroen e-C3 was the best selling BEV in February, with 3,058 units, a sliver ahead of the Renault 5 (3,034 units). This was the Citroen’s first time in the top spot since October.

The Tesla Model Y took third place, with 1,738 units.

The Citroen e-C3’s strong volumes have now established it firmly in the top 3 over recent months, vying with the Renault 5, and Tesla Model Y. Once the Model Y refresh ramps in the next few months, we can expect it to take a strong lead in the last month of each quarter, and the Renault likely to typically outcompete the Citroen for the top spot in the remaining months.

Bear in mind, that these more affordable models (the Citroen and Renault) particularly benefit, as a proportion of their price, from the eco-bonus (compared to more expensive models). The Citroen in particular saw a strong pull-forward ahead of the mid-February deadline for the (higher) 2024 bonus, and will not likely sustain these monthly volumes (at least in the short term). See the analysis of the excellent Raphaëlle Baut for more on this. To put it simply, it will likely be the Renault and Tesla which are regularly competing for the top spot by the middle of this year. That is, unless Citroen has a massive production ramp (and perhaps a price trim) in the works.

The array of other faces in the top 20 are no great surprise, although some models put in notable performances. The Volkswagen ID.3 saw its highest volumes since June, with 822 units (again, perhaps in a pull forward ahead of the eco-bonus deadline). Likewise with Cupra Born, at 679 units, even edging ahead of its previous peak in June.

Since debuting at low volume late last year, the new Alpine A-290 has kept climbing, with February seeing a new high of 480 units, breaking into the top 20 for the first time (16th spot), but again, this may be due to the bonus deadline. The new Kia EV3, which debuted around a similar time, has also stepped up, though remains just outside the top 20 for now.

As usual, we unfortunately don’t have the depth of sales data to spot the initial debuts and early climbs of new BEV models. But let’s keep an eye out for the Hyundai Inster, the Fiat Grande Panda, and later this year, the Citroen e-C3 Aircross, and Renault 4. Any of these could enter the top 20 at some point later this year.

Meanwhile, here’s a look at the trailing 3-month chart, which smooths out the monthly variations:

The new Renault 5 has now firmly established itself in the top spot, after three very strong months. The Renault has already overtaken the Tesla Model Y’s 2024 monthly averages, but the latter’s imminent refresh may narrow that gap a bit. Both are compelling vehicles in their own right, but the mass-market price segment of the Renault obviously exposes it to greater overall demand.

Apart from the Renault now climbing up from 3rd in the previous period (September to November), there’s little movement in the top 11. The only exception is the Dacia Spring, which has come back to decent volume since November. It seems that Renault Group has decided to absorb the heavy hit to the Spring’s margins from bonus-exclusion and tariffs.

The Audi Q4 e-tron, in 14th, has seen its strongest ever 3 months in France, with a change in volume which is a little unusual for an older (and premium) model. Was there a sharp price-cut late last year? Please let us know in the comments, if you have insights.

Look for the Alpine A-290 to potentially join the top 20 in the coming couple of months (unless February was just a one-off stretch to grab the eco-bonus).

Outlook

The flat YoY auto market at least shows some stability, and is a better result than the typical YoY drop which has attended 10 out of the past 12 months. The broader French economy has slowed down, with Q4 YoY growth in GDP of just 0.6% – its weakest YoY growth since 2020. Inflation cooled to 0.8% and interest rates are at 2.9%. Manufacturing PMI improved to 45.8 points in February, up from 45.0 in January.

With an irregular baseline (thanks to last year’s social leasing scheme), new PHEV taxes, and an eco-bonus deadline – we can’t yet point to a consistent pattern emerging in 2025. As I mentioned in last month’s report, we can expect the EU region as a whole to see BEV share in the range of 20% to 22% for full year 2025, due to the tighter emissions rules.

Most legacy manufacturers are still doing “as little as legally possible” to build BEVs, and the overall market is shaped by regulation, not innovation (with some exceptions). The legacy manufacturers will also prioritise their BEV supply into countries that still offer some purchase incentives (allowing them to effectively charge a higher sticker price), relative to those countries which have none (looking at you Germany). France may land on the upside of this equation, and 2025 can’t be worse overall than Europe’s backsliding in 2024.

What are your thoughts about the French EV market? What models are you on the lookout for, or do you expect to be most popular this year? Please jump into the comments section below and join the discussion.

Whether you have solar power or not, please complete our latest solar power survey.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy