Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

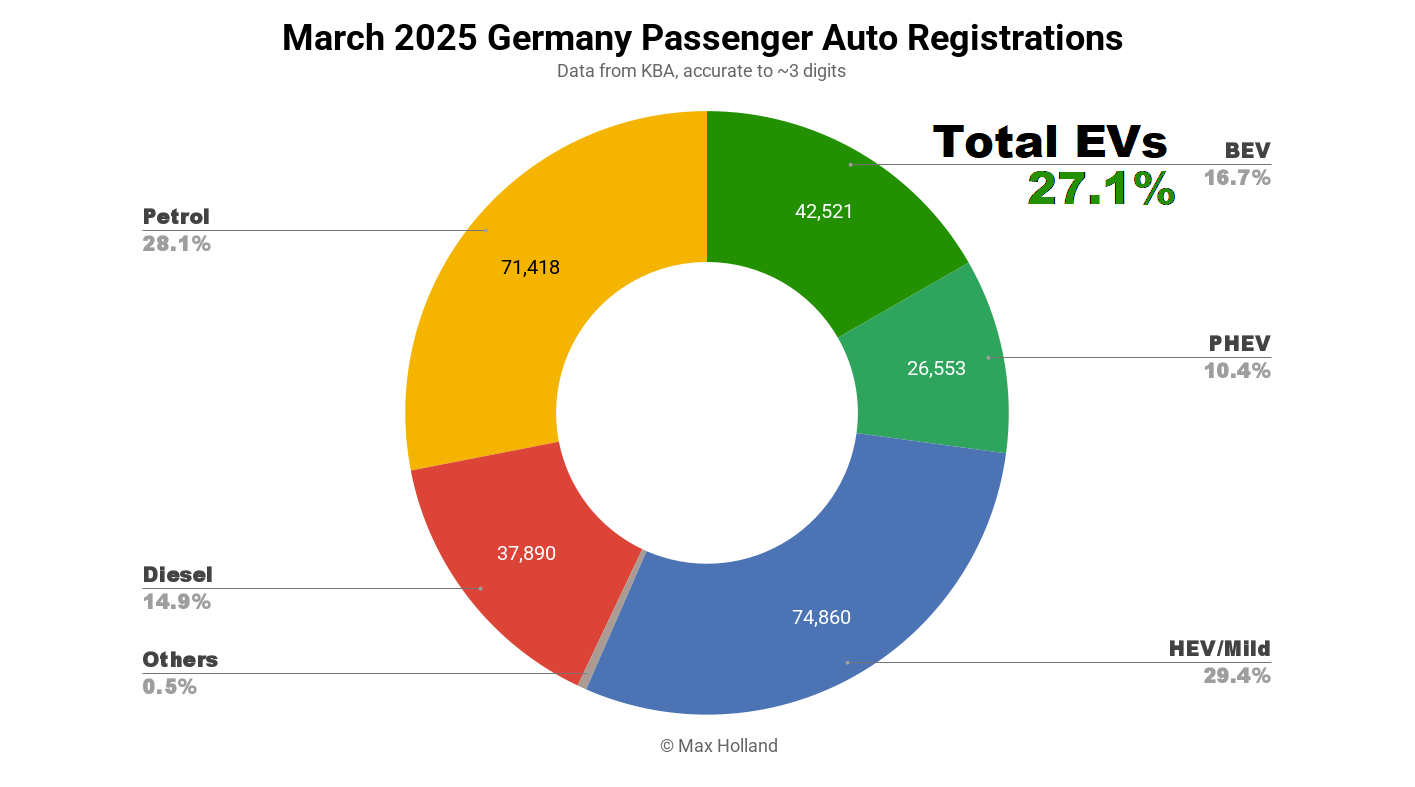

March saw plugin EVs at 27.1% share in Germany, up from 18.0% year-on-year. BEV volume increased by some 35% YoY, from a low baseline, while PHEVs grew 66%. Overall auto volume was 254,497 units, down 3.5% YoY. March’s best-selling BEV was the Volkswagen ID.7.

March’s sales saw combined EVs at 27.1% share in Germany, with full electrics (BEVs) at 16.7% share, and plugin hybrids (PHEVs) at 10.4%. These compare with YoY figures of 18.0% combined, 11.9% BEV and 6.1% PHEV.

The March 2024 baseline was still in a hangover for BEVs, traumatised by the sudden cancellation of all purchase incentives in late December 2023. If we look back much further – to March 2023 – BEV share was then 15.7% (with PHEVs at 6.0%), so last month’s 16.7% for BEVs is barely higher, though PHEVs have increased a bit more rapidly. Not a great result.

In case you’ve been in absentia recently, the hot topic right now is the EU’s walking back and watering down the previous 2025 plans to significantly tighten emissions compared to the 2022-2024 period. The new proposal is to delay the “accounts due” date to the end of 2027, such that 2025-2027 emissions will be pooled and assessed together, rather than requiring 2025 per se to show immediate improvement in emissions.

So this is effectively yet another win for legacy auto, to delay getting serious about BEV sales, until the December 2027 deadline approaches. What’s the betting that – as that deadline itself draws near – they will again find reasons why “it’s too difficult” for them to comply?

Within the past week, most legacy auto companies operating in Europe, and their largest lobbyist, the ACEA, have all been found guilty of anti-competitive practices and operating as a cartel (in both the EU, and in the UK, with the UK SMMT). Fines have been handed out. Just another case of big established interests screwing over consumers, potential competitors, and end-of-life recyclers (amongst others). I mention this just in case you had any lingering illusions about legacy auto’s business practices being trustworthy.

The previous 2025 rules (those now watered-down) would likely have resulted in a region-wide BEV share of roughly 20% (see e.g this Transport & Environment assessment). Now it’s anyone’s guess as to what the 2025 BEV share will likely be – though obviously somewhat lower.

A small proportion of legacy manufacturers (e.g. Volvo/Polestar, BMW Group, Hyundai Motor Group) are at least somewhat serious about selling BEVs (though still taking their merry time), and so may anyway continue on a modest BEV growth trajectory this year.

Meanwhile, most other manufacturers are doing the minimum legally possible (VW Group, Stellantis, Renault-Nissan, Ford, and others) and thus might be expected to just tread-water on BEV progress (yet again) this year.

As I’ve mentioned elsewhere, I have a small hope that some proportion of consumers may finally be determined enough to buy a BEV (and only a BEV) that they turn away from non-BEV offerings. Especially since these folks have now cottoned-on to the fact that somewhat affordable simple BEVs (e.g. the Renault 5, Citroen e-C3, Hyundai Inster, and similar) can indeed exist, can indeed be made (thanks, original 2025 rules, RIP), and can (in theory) be bought.

Stepping back to Germany: To reiterate, the German market anyway won’t be prioritised, due to no longer having BEV incentives available to juice auto makers’ profit margins. So overall, we have to prepare for the likelihood of yet another weak year in Germany’s BEV transition.

Best Selling BEVs

The Volkswagen ID.7 was again – for the third consecutive month – the best selling BEV in Germany, with its highest volume yet, 3,225 units.

In second place was the Volkswagen ID.4 / ID.5, with 2,593 units. The Skoda Enyaq took third spot, with 2,392 units, displacing the Volkswagen ID.3 (now 4th). Another VW Group model was in 5th, the Cupra Born.

The new Skoda Elroq, in just its second month of volume deliveries, did very well to climb to 9th position, from 19th in February. Similarly, the new Audi A6 e-tron also continued to climb, reaching 10th in March.

The new Renault 5 is now back to a growth trajectory in Germany (after holding steady at around 300-400 monthly units soon after its October launch). March saw a record 1,070 registrations, and 13th spot in the rankings. The Citroen e-C3 is also still growing, but more cautiously, with 370 units (and 33rd spot) in March.

The Hyundai Inster, which first saw decent volumes only in January, saw a big jump up to 838 units in March, and entered the top 20 for the first time, in 18th. Just behind, its group-cousin the Kia EV3 is also still climbing, hitting a record 806 units (and 19th spot) in March.

The Leapmotor T03 is still growing slowly but steadily, with 320 units in March (ranking 35th). The Dacia Spring came in slightly ahead, with 438 units (31st spot). The Spring is slightly more affordable (€16,900 vs €18,900) though has lower specs than the T03. Let’s watch the competition between these two.

The upcoming Mercedes CLA was more visible in March. It registered 3 non-customer units previously (January), and an additional 103 units in March. It is still not yet available to order on the Mercedes-Benz website, however, though is obviously gearing up.

The CLA is a D-segment sedan with length of 4,693 mm, fractionally shorter than the Tesla Model 3. Though likely a bit more expensive than the Tesla, the Mercedes will get close to the segment leader in efficiency, and have slightly faster recharging speeds. It will also have a much better equipped interior, so it may give the (now aging) Tesla a run for its money in popularity, especially in its home market of Germany. Let’s keep an eye out for its commercial launch in the coming months.

Here’s the trailing 3-month ranking:

Following 3 months as the best seller, the Volkswagen ID.7 takes the top spot in the trailing chart, ahead of the ID. 4 / ID.5, and the Skoda Enyaq.

There were a few notable changes in the ranking. The Cupra Tavascan has had a steady and solid climb since its launch in August, and has now entered the top 10 for the first time (9th spot). The Audi Q6 e-tron also reached a new high, in 12th spot.

With the last two months seeing strongly climbing volumes, the new Renault 5 has joined the top 20 for the first time, in 15th spot (and should climb further).

Also breaking into the top 20 for the first time was the new Audi A6 e-tron, in 17th place. Having two large premium BEVs in the top 20 ranking is a good result for Audi.

Most impressively, the new Skoda Elroq – after just two months of volume deliveries – has already joined the top 20 in 18th. With another couple of volume months it should climb close to the top 5, let’s watch for that.

Rounding out the top 20, the Kia EV3 also entered for the first time, and should also climb further from here. Waiting just outside in 23nd spot, the Hyundai Inster may also join soon.

With several new models all still climbing, which older models in the top 20 ranks should we expect to make way for these newcomers? I would expect some of the pricier models, such as the 3 BMWs, and the Mercedes EQA, to perhaps shuffle back a few spots. Not because they aren’t good BEVs, nor because their absolute volume will necessarily drop, but just because they are no longer on a strong growth trajectory, and their higher price points put a cap on the size of their addressable market (relative to the Renault 5, Inster, and Elroq).

Similarly, those two new premium Audis mentioned earlier, though still “hot stuff” for now, and likely remaining relatively attractive and selling decently into the future, may give way (in absolute volumes) to these more affordable models in the medium term (later this year).

Now for a quick check on the manufacturing groups:

Volkswagen Group is hugely dominant, now with close to half of the entire German BEV market (48.2%), up from 42.2% three months prior.

BMW Group is still in second, but with share down from 15.6% prior, to 11.5% now. Hyundai Motor Group (HMG) has now stepped up into third place (increasing from 6.0% to 7.6% share), a great result. No prizes for guessing which two models have propelled this recent rise.

Mercedes Group is pushed back to fourth spot for now, down from 12.3% to 7.3%. This will improve soon after the new CLA launches later this year, but it may struggle to displace HMG in a hurry.

Further back, Tesla also lost share (7.5% down to 4.4%), now in 7th, and we will have to see how the new Juniper Model Y is received, and where its volume stabilises (perhaps end of Q3), to know whether Tesla will get back into the top 5.

Outlook

Over the past 12 months, Germany’s domestic auto market volume has decreased YoY by some 3%. Not a precipitous drop, but not great given the industry’s centrality in the economy. Fortunately, there was a slight increase in auto exports over the same period which mostly compensated. Now that there are higher tariffs in place in the US market (traditionally important for the premium German brands), the future is less secure.

The broader economy saw a 0.2% YoY GDP contraction in Q4 2024 (latest data), a slight improvement over the 0.3% contraction in Q3. Inflation measured 2.2% in March, and interest rates reduced to 2.65%. Manufacturing PMI improved to 48.3 points in March, from 46.5 points in February.

As mentioned above, although the EU’s walkback of the original 2025 vehicle emissions targets is very disappointing, the broadening availability of more affordable BEV models may lessen the blow. It’s encouraging to see models like the Renault 5, Hyundai Inster, Skoda Elroq, and Kia EV3 growing strongly. Their presence will surely be noticed by German’s car buyers, and perhaps tip consumer demand in the right direction, even if manufacturers still want to slow-walk the transition.

What are your thoughts on Germany’s auto market, auto industry, and the EV transition? Please join in the conversation in the comments below.

Whether you have solar power or not, please complete our latest solar power survey.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy