Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

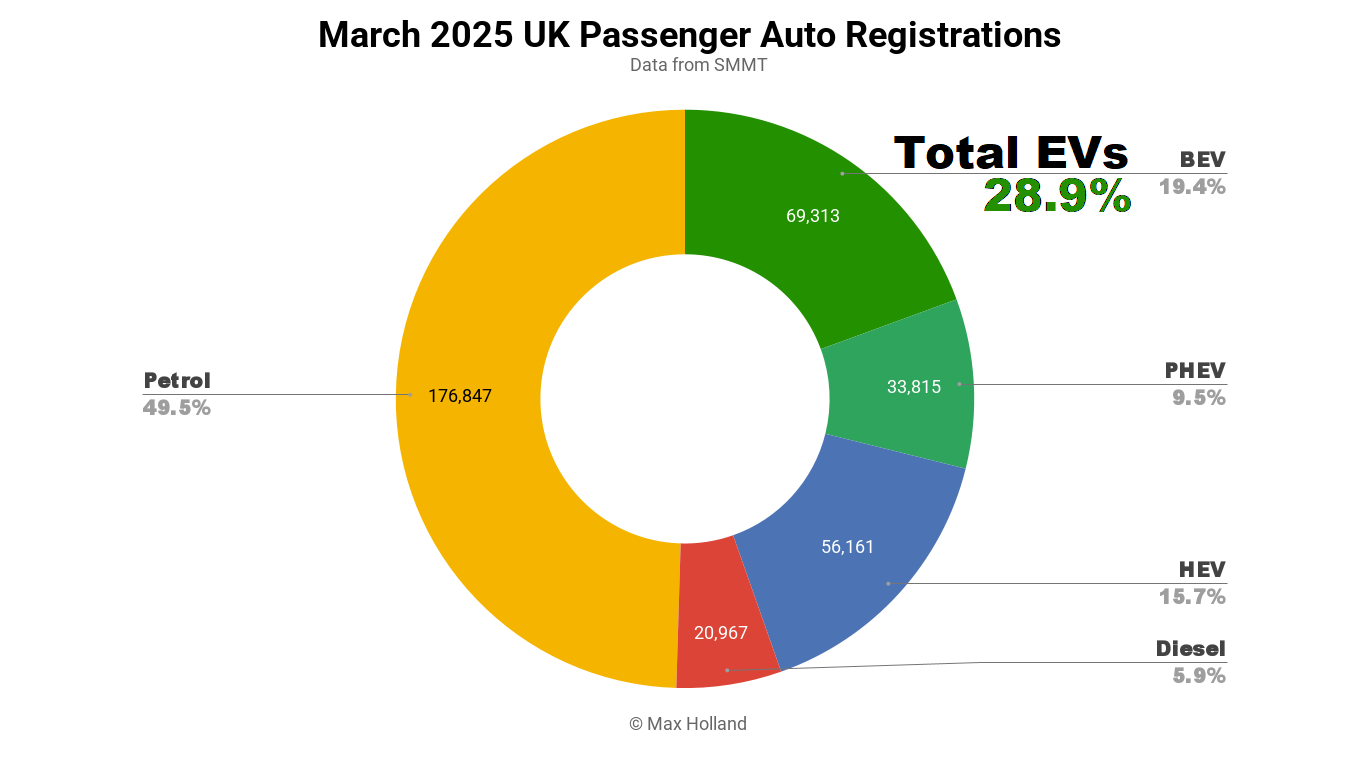

March saw plugin EVs take 28.9% share of the UK auto market, up from 22.9% year-on-year. BEVs grew volume by 43% YoY, while PHEVs grew 38%. Overall auto volume was up some 12% year-on-year, at 357,103 units. Tesla was the UK’s leading BEV brand in March.

March’s sales totals saw combined plugin EVs take 28.9% share of the UK auto market, with full electrics (BEVs) taking 19.4%, and plugin hybrids (PHEVs) taking 9.5%. These compare with YoY shares of 22.9% combined, 15.2% BEV, and 7.7% PHEV.

It is fairly normal for BEV share to take a dip in March of each year. Because March is the first month in each year that vehicle license plates actually show the current year (“xx25 xxx”), folks who plan to get a new car in a given year (and show it off as “new” to their mates) often take the plunge in March. Thus March is normally the biggest overall auto sales month of the year, and is also an opportunity for brands and dealers to clear out older stock.

Since we’re in a technology transition, selling old stock typically means ICE vehicles are over-represented, so plugin share sees a slight dampening in the month compared to say a February or a May. Despite this, the actual BEV sales volume in March increased healthily YoY, up 43.2% to a new single-month record of 69,313 units. PHEVs also got a decent bump, up 37.9% YoY, to a new volume record of their own – 33,185 units.

Another factor this March was that the “Expensive Car Supplement” tax is now (from April 1st) levied on BEVs with MSRP of £40,000 or over. So March was the last chance to avoid this tax, creating a pull forward effect ahead of the deadline. Thus we should expect to see April and May with a slight hangover in BEV registrations and share. The arrival of the new Tesla Model Y Juniper in May and especially in what are likely to be large (end-of-quarter) volumes in June, should see BEV share back on a more positive track by that point.

Recall also that the ZEV mandate has a headline target of “28% ZEV” in 2025, up from “22% ZEV” in 2024. In reality that should translate into an actual BEV market share of around 24% to 25% this year, so we can expect to see monthly BEV share steadily ramp up across H2 as the December deadline approaches.

Most Popular BEV Brands

Tesla was once again the UK’s best selling BEV brand in March, taking 10.5% of the BEV market. Note that the Model Y Juniper is not yet selling in the UK, its deliveries are scheduled to begin in May.

In second place was BMW with 7.99% share, only a few units ahead of Volkswagen, with 7.97%.

Mini, Peugeot, and Mercedes dropped from last month’s 4th, 5th, and 6th spots (respectively), and Audi, Kia, and Ford each stepped up by several places to fill those spots.

The rest of the top 20 didn’t see any very notable moves, except perhaps that BYD climbed a few spots and is now in 8th spot (from 20th in full year 2024). This seems to relate to a significant batch shipment of the BYD Seal sedan, which saw record UK volume in March, and may have been in the top 10 best selling BEV models (our model data is slightly patchy, so it’s hard to say for sure). Skoda also saw a jump of 5 spots compared to February, and this appears to be mainly due to the volume debut of the new Elroq, which ranked inside the top 20 models.

Recall that the UK’s RHD market often sees very irregular batch shipments, giving somewhat erratic monthly totals, and consequent rankings that sometimes resemble a game of snakes and ladders.

As mentioned, our model data is patchy, with many models initially registered as “unknown” and taking several weeks to resolve. However, the data does already point to the Kia EV3 again being in the top 5 BEV models in March (after a slight dip in February). The Renault 5, which we think arrived in February (with around ~160 units), took a break in March with just around ~60 units. Its close rival, the Citroen e-C3, did manage to step up volume to around ~300 units in March, a decent result this early in its ramp-up (following its January UK debut). There’s still no clear record of the Hyundai Inster as of time of writing, but we can surely expect its UK debut soon.

The Dacia Spring saw a healthy ~700 units in March, its highest ever UK volume (its debut was in October 2024). Its closest rival, the Leapmotor T03 had only seen a handful of showroom units registered in February, but managed to step up to ~60 units in March, so let’s keep an eye on it. The competition at this economy end of the market will help keep all the pricier segments honest – both of these models have price tags under £16,000!

The new MG S5 compact-mid SUV seems to have made its UK debut in March, though with just a few initial units for now. For more on the specs of this model, see my recent Norway report. MG is a popular BEV brand in the UK, so it will be interesting to keep an eye on the new MG S5 over the coming months.

Here’s a look at the 3-month brand rankings:

Tesla remains in first place for now. Since the new Model Y will only arrive in May, it is possible that Tesla may take a temporary dip in April, giving Volkswagen or BMW (now in second and third spots) a chance to momentarily catch up.

After a quiet Q4 2024, Kia came back to its usual strength in Q1 2025, largely thanks to the new EV3 proving very popular (it’s already in the top 5 BEVs of Q1).

I had earlier promised to compare Q4 2024 brand performance to Q1 2025 (when we had the data), to see if we could expose those laggard brands which had to make a last minute rush to meet the 2024 ZEV mandate. The stand outs are Honda, Mini and Renault, and to a lesser extent, Ford. The contrast is muddied by the fact that all these brands now have to gear up for the even tighter 2025 mandate, so their “Damascene Conversion” was actually seen in late 2024, rather than between 2024 and 2025.

Honda, however, does stand out. Its 2024 Q4 BEV volume was 741 units. Anyone care to have a guess as to Honda’s 2025 Q1 BEV volume? Jump in the comments below to place your bets (no peeking at online data sources before commenting please – just have an honest punt).

Outlook

The UK auto market had its biggest March since 2019, and has recently been on a modest recovery streak. The overall UK economy saw another up-tick in Q4 2024 (latest data), with 1.5% YoY growth in GDP, following on from a Q3 figure of 1.2%. This puts it in a better spot than most other European peers. Inflation was at 2.8% in February (latest), with interest rates now at 4.5%. Manufacturing PMI fell to 44.9 points in March, from 46.9 points in February.

What effect the recent changes in global trade tariffs might have is anyone’s guess. The UK tends to be a capital-flight destination, so it’s possible that it may see funds coming in which were formerly parked in the US.

The ZEV mandate proved itself mostly effective in its first year of operation (2024), and will likely do so again, with its tighter targets, this year. Of course the industry will whine to have these targets relaxed, and call for incentives to meet this “difficult and costly” target. They have recently been shown to be dishonest brokers, with the legacy auto makers, along with their UK lobby, the SMMT, recently being found guilty of illegal cartel behaviour and deceiving consumers.

What are your thoughts on the UK EV transition? Are you in the market for a BEV, or watching the rise of any particular brands? Please join in the conversation in the comments below.

Whether you have solar power or not, please complete our latest solar power survey.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy