Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

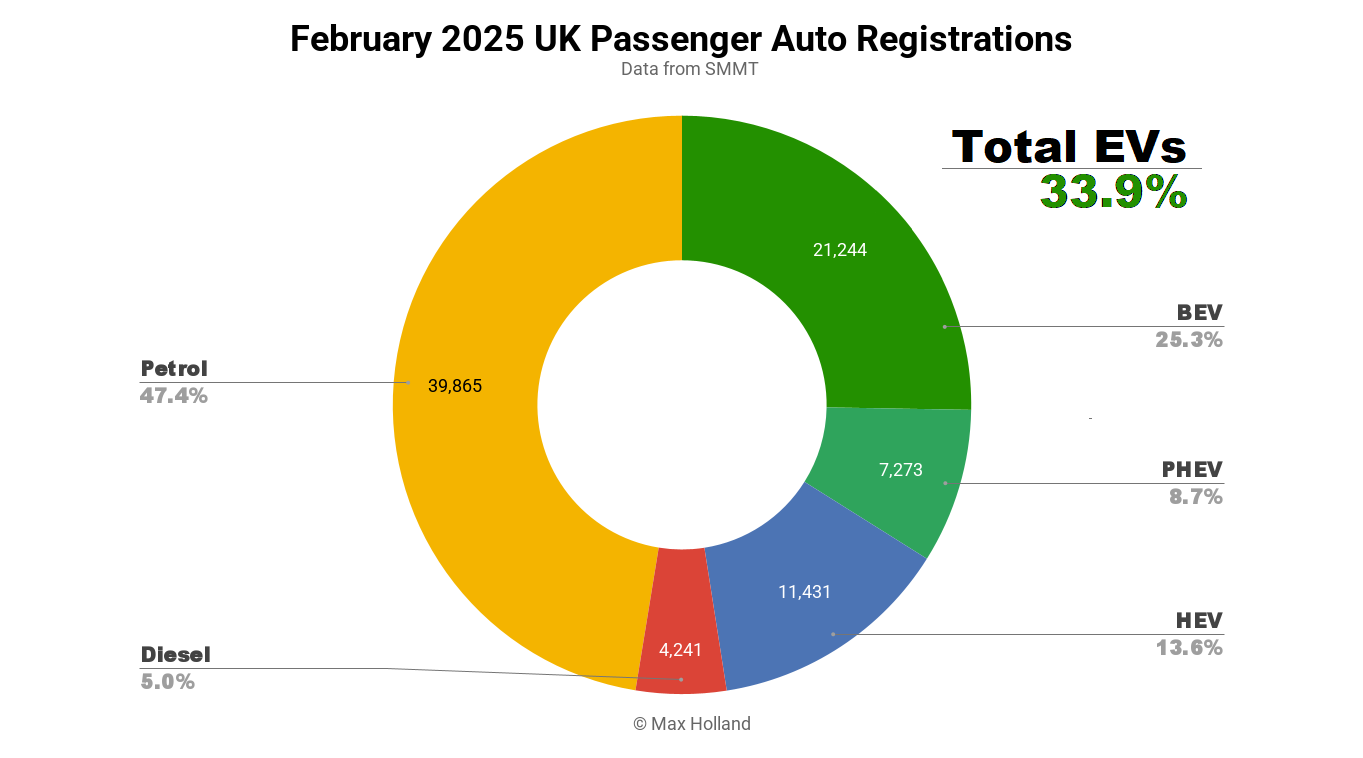

February’s auto market saw plugin EVs take 33.9% share in the UK, up from 24.8% year-on-year. BEVs grew in volume by 42% YoY, with PHEVs close to 20% growth. Overall auto volume was 84,054 units, almost flat YoY. The UK’s leading BEV brand in February was Tesla, with two of the top 3 overall best-selling vehicles, and 18.5% share of the BEV market.

February’s sales totals saw combined plugin EVs take 33.9% share in the UK, with full electrics (BEVs) taking 25.3%, and plugin hybrids (PHEVs) taking 8.7%. These compare with YoY shares of 24.8% combined, 17.7% BEV, and 7.2% PHEV.

The big change in BEV market share year-on-year was partly a result of baseline effects. A few brands were at a very low ebb last February, and reappeared in decent volume this February (especially Mini, Volkswagen, Peugeot, Ford, and Renault) each contributing at least 500 extra units (>1,000 in the case of Mini and Volkswagen). These temporary irregularities can often happen in the UK’s right-hand-drive market (served by batch shipments), especially in a modest volume month like February.

There’s also currently an expected pull-forward of BEV sales ahead of April’s introduction of the “expensive car tax” (applying to BEVs for the first time). This has given February’s BEV volumes a boost. There will obviously be a consequent hangover in April and May.

I would normally say that we might therefore have to wait till Q3 to get a clearer picture of the “settled” powertrain shares for 2025. But by the end of Q3, the December deadline for the ZEV mandate will be looming, and strongly shaping the BEV market. In short, 2025 will see several ups and downs on the journey to meeting the year’s ZEV mandate of “28% ZEV”, but the industry will likely get there in the end.

February saw a record low market share of diesel-only vehicles, at just 5.0%, down from 5.9% YoY.

Most Popular BEV Brands

Tesla was the UK’s leading BEV brand in February, with 18.5% of the country’s BEV market. Tesla’s unit volume increased by almost 20% YoY. According to SMMT data, the Model Y and Model 3 took number two and three spots (respectively) in the overall auto market in February.

In second place was Volkswagen brand, with 7.5% of the UK market. BMW brand came in third with 6.6%.

There were no great surprises in the top 20. Tesla was back to decent volumes after its January lull, and Mini picked up several spots also. Most brands were down on volume compared to January, which is normal given that February is the lowest volume month of the year.

We don’t have very reliable model data, but it appears that the new Renault 5 finally made its UK customer delivery debut in February, with close to 160 units registered. The original Renault 5 was fairly popular in the UK, and the new BEV has already won praise and awards from UK reviewers, so there’s plenty of interest. The Renault 5 starts from £22,995 in the UK for the 40 kWh variant (310 km WLTP).

The Renault’s closest competitor, the Citroen e-C3, which arrived in January with just a few units, stepped up to over 140 units in February. The Citroen starts from £21,995 in the UK, so the competition between these two should be healthy.

Another segment competitor, the new Hyundai Inster, may (or may not) have debuted in the UK in February – the DVLA data (via EUEVs) does list an “unknown” Hyundai BEV model at 49 units, which could be the Inster (though could just be incorrectly categorized units of other Hyundai models). Other potential segment competitors include the Fiat Grande Panda, and Vauxhall Frontera. All of these sub-compacts will compete for attention in the below-£25,000 price point, so let’s see how they get on.

Meanwhile, the Dacia Spring, at an even lower price point of £14,995, continued to sell reasonably well, with around 150 units in February. Its closest competitor, the Leapmotor T03 (£15,995), has already registered some showroom units and is available to test drive, though it appears that customer deliveries have not yet formally begun.

The new Audi S6 / A6 e-tron continued to grow in the UK, with around 325 units in February, a good result for Audi.

Let’s now have a look at the 3-month brand rankings:

Tesla still has a clear lead in the 3-month ranking, with 15.4% share of the UK BEV market, more than the two runners-up combined. Volkswagen brand comes second with 8.6%, and BMW is in third with 6.6%.

Amongst the fairly predictable top 20, notice that Ford is now often showing up in the top 10, thanks to the ZEV mandate. Having long been one of the UK auto market’s most popular overall brands, it now has to sell decent numbers of BEVs.

This is a big change from a couple of years ago, when Ford was only selling low hundreds of Mach-e units per month. Now the brand typically registers at least 1,000 units per month, led by the Ford Explorer. The ZEV mandate is clearly working to prod these laggard legacy brands into taking action.

Outlook

UK auto market volume has been overall relatively stable over the past year or so, typically only seeing YoY variations (up and down) in the range of 1% to 3%, albeit still quite far down from the pre-2020 levels (as are most other European markets). The broader UK macroeconomy is reasonably steady, with modest (but at least positive) 1.4% YoY GDP growth as of Q4 2024. Inflation has recently crept back up to 4%, and interest rates are at 4.5%. Manufacturing PMI was at a low of 46.9 points in February, a fall from January’s 48.3 points, and from recent positive territory in mid 2024.

As mentioned above, there are various temporary influences shaping the UK BEV share in these months, and we won’t get much of a chance to see a “default” market share this year before we reach the finish line. However, with more and more affordable BEV models arriving – in large part because the ZEV mandate is forcing legacy auto to offer them – it seems clear that the mandate is working, and 2025’s higher bar will be reflected in real progress in the EV transition this year.

What are your thoughts about the UK’s auto market, and the transition to EVs? Please jump into the comments section below to join the conversation.

Whether you have solar power or not, please complete our latest solar power survey.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy