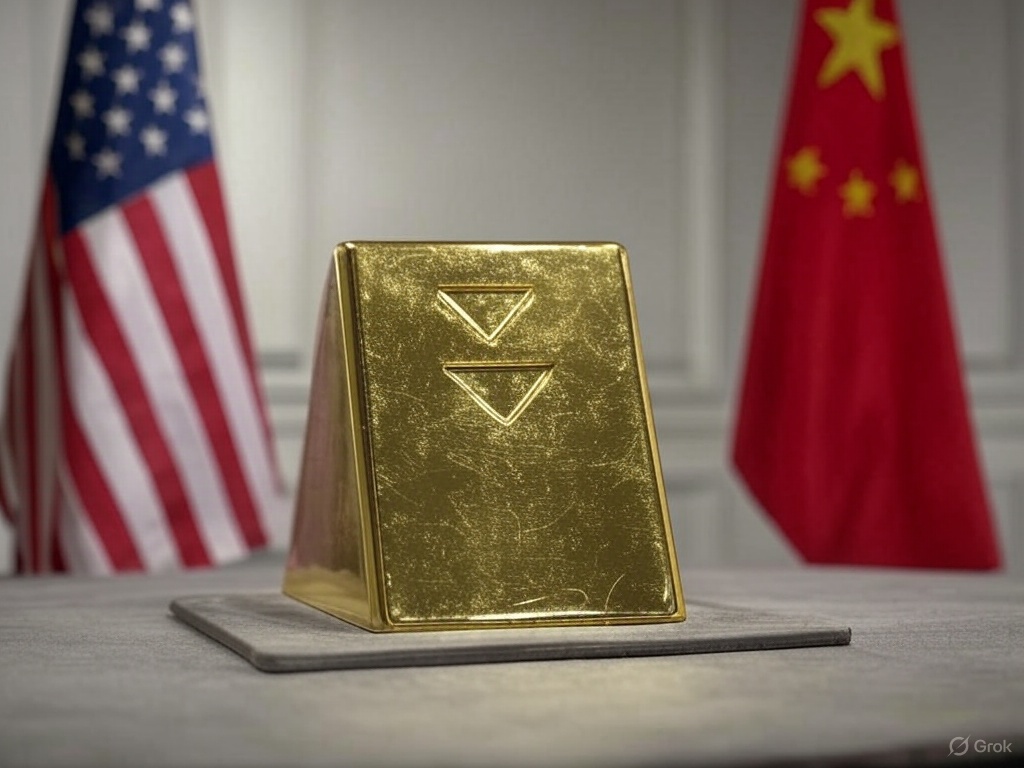

Gold prices tumbled nearly 2% on Friday, marking one of the sharpest single-day declines in recent weeks. The drop came as investor sentiment shifted following positive developments suggesting a possible easing in the long-standing US-China trade tensions.

This renewed optimism about global trade stability reduced the demand for safe-haven assets like gold, traditionally sought during periods of uncertainty and geopolitical risk.

Market Reaction to Trade Developments

News reports on Friday indicated that officials from both the United States and China were making strides toward de-escalating trade hostilities. Sources suggested that both sides were considering measures to roll back certain tariffs and create more favorable conditions for dialogue.

Investors, encouraged by these signs of diplomatic thaw, moved money out of safe-haven assets like gold and into riskier investments, including equities and emerging market assets. As a result, spot gold prices slid 2% to close at around $2,320 per ounce, while US gold futures experienced a similar decline.

Why Gold Reacts to Trade Tensions

Gold is widely considered a “safe-haven” asset — meaning it tends to attract investors during times of economic or political uncertainty. When fears of trade wars or international conflicts rise, gold prices typically move higher. Conversely, when tensions ease and economic optimism returns, demand for gold diminishes.

The recent cooling in US-China trade tensions has reduced immediate concerns over a global economic slowdown, making riskier assets more attractive and thereby weighing heavily on gold.

Other Factors Affecting Gold Prices

In addition to easing trade fears, several other factors contributed to gold’s Friday decline:

-

Stronger US Dollar: The US Dollar Index (DXY) strengthened, making gold more expensive for holders of other currencies.

-

Rising Bond Yields: US Treasury yields rose slightly, offering investors a safer, yield-generating alternative to holding non-yielding assets like gold.

-

Technical Selling: After gold prices recently touched near-record highs, profit-taking among investors likely accelerated Friday’s sell-off.

Outlook for Gold

Despite Friday’s sharp drop, many analysts remain bullish on gold in the medium to long term. Factors such as persistent inflationary pressures, central bank buying, geopolitical hotspots (like tensions in the Middle East and Eastern Europe), and potential monetary policy shifts by the US Federal Reserve could continue to support gold prices.

Analysts also note that while trade tensions may be cooling for now, any setback or renewed hostility between the world’s two largest economies could quickly restore safe-haven demand for gold.

Investor Takeaways

For investors, the recent price dip might present a strategic opportunity to accumulate gold at lower levels. However, market watchers suggest keeping a close eye on further US-China negotiations, Federal Reserve policy signals, and global economic indicators to better gauge where gold prices might head next.