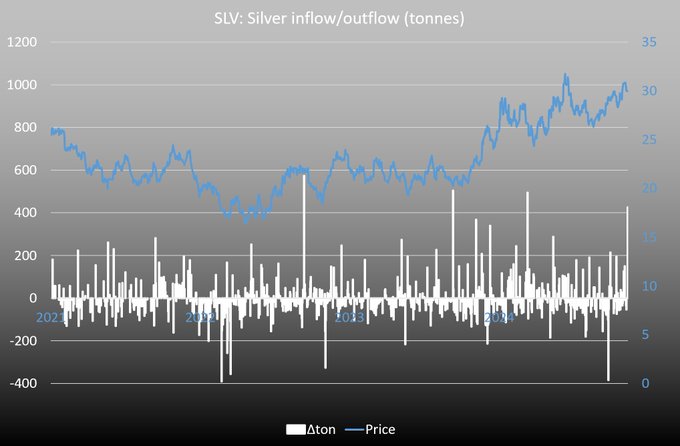

The silver market witnessed a significant event as the iShares Silver Trust ($SLV) added 425 tonnes of silver to its holdings. This marks the fourth-largest addition over the past four years and signals strong investor interest in the precious metal. Such a substantial increase in silver reserves raises important questions about market trends, investment strategies, and future price movements.

SLV’s Role in the Silver Market iShares Silver Trust (SLV) is one of the largest exchange-traded funds (ETFs) backed by physical silver. It serves as a key investment vehicle for individuals and institutions looking to gain exposure to silver without the need to own physical bullion. The fund’s movements are closely watched as they reflect broader trends in silver demand and investor sentiment.

Understanding the 425-Tonne Addition Adding 425 tonnes of silver in a single day is a notable event, considering the fluctuations in silver demand and supply. To put this into perspective, the amount added equals approximately 13.7 million troy ounces of silver. This addition signals a strong inflow of investor funds into SLV, indicating heightened interest in silver as a safe-haven asset or a hedge against inflation and economic uncertainties.

Historical Context: Fourth-Largest Addition in Four Years The recent addition ranks as the fourth-largest inflow into SLV since 2021. Such sizable accumulations typically occur during periods of increased economic uncertainty, inflationary concerns, or shifts in central bank policies affecting commodity investments. Previous major additions have often been linked to global financial instability, heightened market volatility, or speculative demand for silver.

Impact on Silver Prices The infusion of silver into SLV can have a direct impact on silver prices. Large inflows into silver ETFs often create upward pressure on prices by reducing available market supply. In response to this latest addition, silver prices may experience increased volatility, with potential gains if investor interest sustains momentum.

Possible Reasons Behind the Surge in Silver Demand Several factors could have driven this significant silver acquisition:

- Inflation Hedge: Investors often turn to silver as a hedge against inflation, particularly during periods of rising consumer prices.

- Economic Uncertainty: Global economic concerns, including geopolitical tensions and recession fears, drive safe-haven investments.

- Industrial Demand: Silver is an essential component in industries such as electronics, solar panels, and medical applications, contributing to long-term demand growth.

- Central Bank Policies: Interest rate decisions and monetary policies influence investor appetite for precious metals.

Market Outlook and Future Trends With SLV making such a significant addition, analysts will closely monitor whether this trend continues. If similar inflows persist, silver prices could see sustained growth, attracting even more investors. However, external factors such as Federal Reserve policies, geopolitical developments, and industrial silver demand will play a crucial role in shaping future price movements