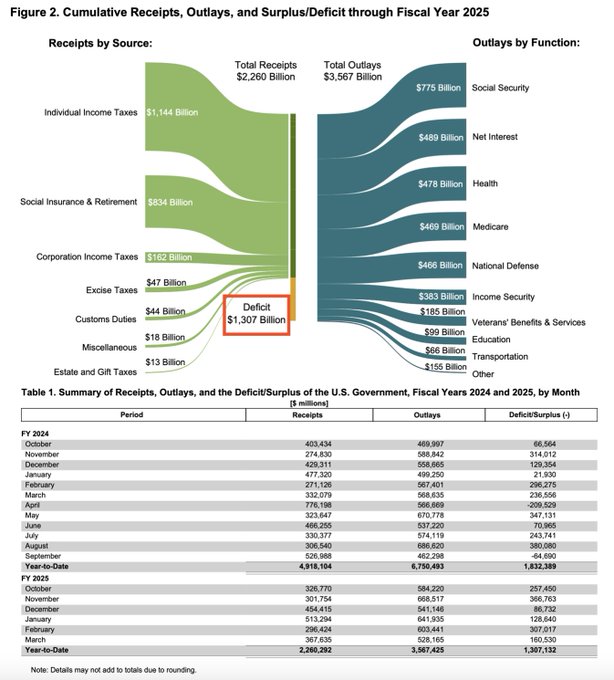

The latest update from the US Treasury reveals a significant development in the nation’s fiscal landscape. With the fiscal year now half over, the total year-to-date (YTD) deficit has reached an astonishing $1.307 trillion, marking a 22.8% increase compared to the same point in FY2024. Despite expectations for the typical surplus in April, the current trajectory suggests that the deficit for FY2025 is on pace to exceed $2 trillion. This fiscal scenario has reignited debates about the economic outlook, the sustainability of government spending, and even the role of traditional hedges such as gold in times of financial uncertainty.

Detailed Analysis of the Deficit Update

Current Fiscal Status

-

Deficit Growth:

At the mid-point of FY2025, the US Treasury reports a YTD deficit of $1.307 trillion. This figure represents a 22.8% increase from the corresponding period in the previous fiscal year. The accelerated deficit growth indicates mounting challenges in balancing government expenditure and revenue. -

Typical Fiscal Surplus in April:

Historically, April tends to see a fiscal surplus due to timing adjustments and reporting nuances. However, despite this anticipated bump, the broader fiscal dynamics remain worrisome. The surplus is unlikely to offset the overall expansion in the deficit, particularly given the current pace of spending and revenue shortfalls. -

Outlook for FY2025:

Projections based on current figures point to a fiscal year-end deficit that could surpass $2 trillion. This scenario underscores ongoing structural issues, such as high discretionary spending, mandatory outlays (like Social Security, Medicare, and interest on the national debt), and potential weaknesses in revenue collections stemming from tax policies.

Factors Driving the Deficit Surge

Several key factors contribute to the rising deficit:

-

Increased Government Spending:

The current fiscal policies have led to a substantial increase in government spending. This rise is partly due to enhanced fiscal measures including economic recovery plans, infrastructure investments, and increased public sector funding, all of which add pressure to the overall fiscal balance. -

Revenue Challenges:

Revenue shortfalls, whether from lower tax collections or reduced growth in taxable income sectors, have compounded the difficulties in offsetting rising expenditures. Economic uncertainties and shifts in policy have contributed to a less robust revenue stream relative to spending demands. -

Interest Payments and Debt Servicing:

As the national debt grows, so too do the interest expenses required to service that debt. These costs have become a significant component of the budget, reducing the fiscal space available for other essential spending and pushing the deficit higher.

Economic Implications and the “Got Gold?” Question

Broader Economic Concerns

The soaring deficit has several implications for the US economy:

-

Creditworthiness and Borrowing Costs:

A rising deficit often raises concerns about fiscal sustainability, which can affect the nation’s credit rating. Increased borrowing costs could, in turn, impact economic growth and investment. -

Inflationary Pressures:

Prolonged high deficits may contribute to inflationary pressures, especially if accompanied by expansive monetary policies. This could lead to higher consumer prices and erode purchasing power. -

Investor Sentiment:

Fiscal imbalances might influence investor confidence. When government finances appear strained, investors often look for safe-haven assets to hedge against market volatility.

The Role of Gold

The headline “Got gold?” hints at a common economic strategy during periods of fiscal uncertainty. Gold is traditionally seen as a safe-haven asset that tends to hold its value or appreciate when traditional currencies and fiscal measures face instability. With rising deficits and potential economic challenges ahead, investors might consider turning to gold as a hedge against inflation and currency devaluation. This trend has historical precedence, as periods of significant fiscal and economic stress are often accompanied by surges in gold prices.