Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and/or follow us on Google News!

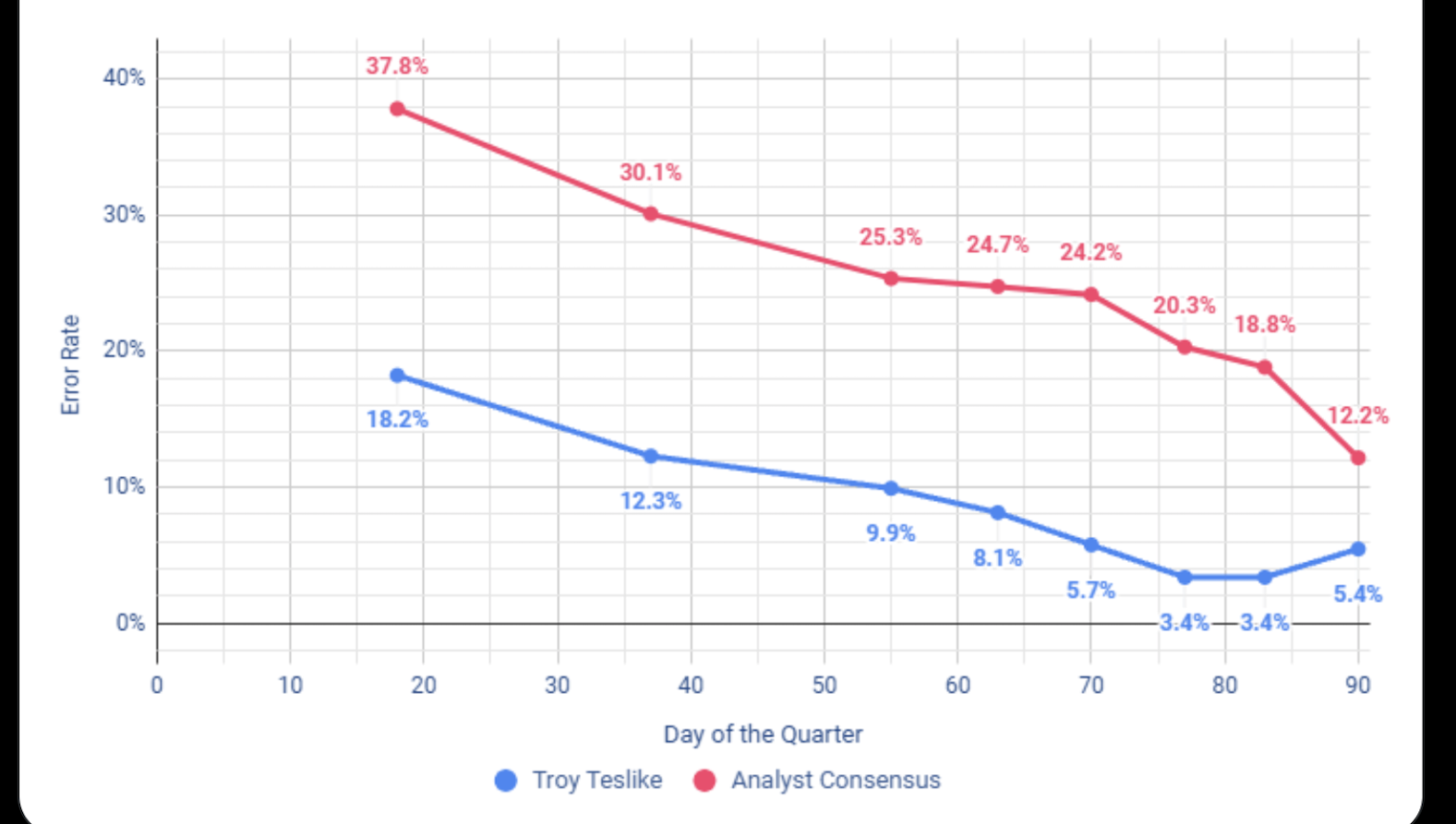

When I was working on my recently article on Tesla’s long-term quarterly sales trends, I popped over to Troy Teslike’s account to see if there was anything notable I should consider for the model-specific sales split. The most interesting thing I found there, though, was this post, and particularly the graph in it:

Troy, as far as I have seen, tracks Tesla production and possible delivery numbers better than anyone else on the planet (outside of Tesla itself, of course). He has developed quite a system and database, with critical ongoing data inputs. I also noticed him pointing out in some comments that several famous Tesla stock analysts subscribe to him on Patreon (for the quickest, most up-to-date data).

When you look at that graph, you probably think that the lines are quite parallel because they are using similar sources and coming to similar conclusions, with Troy just being a bit more pessimistic in this case. I have the hunch that aside from some shared sources, many of the analysts are relying on Troy’s data. I think it could be more of a case of analysts following Troy than analysts and Troy lining up. Of course, major markets like China and Europe have easy-to-access sales data and account for much of Tesla’s story, so maybe it’s more about analysts following those trends with a bit of seasoning for quicker insights in the US market and Tesla production.

In any case, let’s get to the trend. Clearly, analyst expectations for Q1 Tesla sales were far too high earlier in the quarter and then gradually slid down, getting closer and closer to Tesla’s actual Q1 sales once those were finalized and shared. Despite getting closer and closer to reality through the quarter, all parties ended up vastly overestimating Tesla sales. Why?

It seems to me that the core issues were as follows:

- People trusted Tesla’s statements that 2025 would be a return to growth (Elon Musk estimated 20–30% growth across the year), and in particular assumed that meant better Q1 sales numbers.

- People assumed the new Tesla Model Y would ramp up faster and give Tesla a boost in the 1st quarter. (The production ramp-up has been slower than expected, and demand may not be as strong as expected — but that will take longer to see clearly.)

- People assumed more of a ramp-up in Cybertruck production and sales, not such an extreme challenge selling Cybertrucks.

- People didn’t expect Tesla Model 3 sales to drop as much as they did.

As data came out, week after week, Troy and other analysts kept seeing that things weren’t going as well as expected and kept having to adjust their forecasts downward. Even so, the overall analysts forecast was 12% too high!

What does all of this mean for Q2? Who knows? Perhaps expectations will still be too high because of too much belief in the points listed above. Or perhaps new Model Y production and sales will kick off faster and bigger than expected and the trend will be reversed. My money would be on the former, not the latter, but no one really knows and we’ll just have to see how things are looking as the numbers come in.

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy