Bitcoin holds $87K but crypto dips 2.7% today. Tariffs, Bitcoin ETF outflows hit prices—will BTC/USD stay above $86K?

The Bitcoin price is stable at press time, rejecting bear attempts over the past two trading days. BTCUSD is trading above $87,000; buyers have the upper hand, though the broader crypto market is down.

Bitcoin Price Firm but Flat: Everything To Know About BTC USD This Week

According to Coingecko, the total crypto market cap is $2.9 trillion, down 2.7% in the last 24 hours.

However, Bitcoin is impressively soaking up any attempt to push prices lower. If this continues, it may anchor the next wave of higher highs for BTC USD.

Technically, Bitcoin price has support at around $86,000 and resistance at $89,000 and $90,000.

(BTCUSD)

Bulls must convincingly close above the liquidation zone for the uptrend from Q4 2024 to continue. This could set the ball rolling, perhaps even lifting prices to $100,000 and all-time highs.

Nonetheless, bullish as traders may be, some factors are slowing momentum and depressing crypto prices, as clear in the events in the past 24 hours.

Why Is Crypto Down Today? Will it Recover?

After gains in Q4 2024, prices are depressed, with most altcoins—including some of the best cryptos to buy—posting double-digit losses and even reversing gains from late 2024.

Ethereum, Solana, Cardano, and even EOS are under pressure, sliding sharply from 2025 highs.

A combination of factors might heap more pressure on prices. Even though the Federal Reserve plans to eventually lower rates, subject to how macroeconomic factors evolve, tariffs under the Donald Trump administration continue to heighten market nerves.

If new tariffs are announced, they could disrupt the economy, forcing investors to tighten their purse strings and channel funds to bonds instead of risky assets, mainly cryptos. This current state of risk-off sentiment explains why the Bitcoin uptrend is labored and why crypto prices are generally depressed.

As long as Bitcoin stays below $90,000 and bulls fail to follow through, weak hands might choose to cash out and exit their positions.

This preview could be the case from on-chain data because short-term holders are already in the red and may not wait longer.

Short-term holders are deep in the red, currently sitting on -12% of aggregate losses—levels not seen in the past two years, except at the bottom of the 2024 correction.

Just recently, at the ATH, they were sitting on 28% of profits.

Total decimation. pic.twitter.com/xqakwD8Uyb

— Sina

21st Capital (@Sina_21st) March 10, 2025

Any price drop could trigger a panic sell-off, accelerating the decline and increasing pressure on altcoins.

Will BTC USD Stay Above $86,000?

The big players must be involved if Bitcoin is to close above $90,000 and race to $100,000.

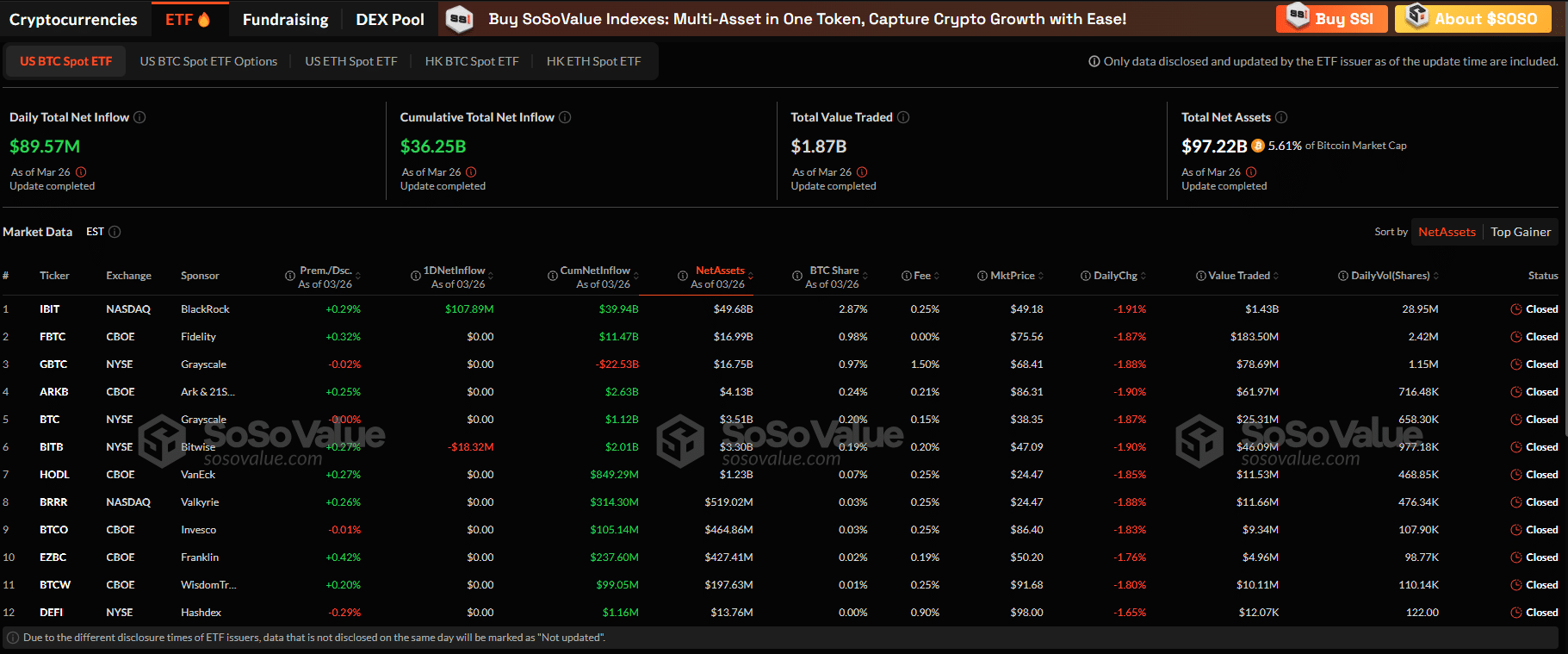

According to Soso Value, there is institutional interest, and more spot Bitcoin ETF shares are being bought.

Yesterday, over $89 million in BTC-backed shares were purchased by institutions and high-net-worth individuals in the United States. Notably, Bitcoin ETF inflows have been encouraging this week, a net positive for bulls.

(Source)

Additionally, more Bitcoin whales are engaged. On-chain data shows that the number of whales holding between 100 and 10,000 BTC has increased since Bitcoin fell below $80,000. This points to possible accumulation, with savvy traders buying the dip and even considering some of the hottest presales to buy right now.

Despite short-term holders in the red zone, on-chain data does not hint that they are rushing to sell.

Since January 1st, 2025, Short-Term Holders (STH) have increased their supply by 201,743 BTC. The cohort currently holds 5,750,076 BTC.

At the peaks of previous cycles, STH held 8.4M and 7M BTC, respectively.

In essence, around 200K BTC are currently sitting at an unrealized… pic.twitter.com/i65zLLoz0Z

— Axel

Adler Jr (@AxelAdlerJr) March 25, 2025

Since early January 2025, they have accumulated and currently hold over 200,000 BTC.

DISCOVER: 20+ Next Crypto to Explode in 2025

Bitcoin Price Today: Why Crypto Is Down and Will BTC Hold $86K in 2025?

- Bitcoin Price Today: BTC stable above $87,000 despite crypto prices falling

- Why Crypto Is Down: trade wars and Tariffs Could Force Capital Away from cryptos

- Will BTC/USD hold above $86,000? Bitcoin ETF outflows slow down as institutions double down

The post Will BTC USD Hold $86K? Why Is Crypto Down Today? appeared first on 99Bitcoins.